The inauguration of Donald Trump for a second term as President of the United States in January 2025 has introduced a new wave of uncertainty and opportunity for international corporate treasury teams. With significant policy shifts in trade, taxation, immigration, and regulatory frameworks, businesses across the globe are recalibrating their strategies to navigate the evolving economic landscape. Treasury teams, positioned at the intersection of financial risk management and strategic planning, face unique challenges in adapting to these changes while safeguarding liquidity, optimizing capital structures, and ensuring compliance.

One of the most consequential developments under the Trump administration is the implementation of sweeping tariffs, including a 25% levy on imports from Mexico and Canada and a 10% duty on Chinese goods, as reported by CNBC. These measures, part of the administration's "America First" agenda, are expected to disrupt global supply chains, increase input costs, and create volatility in currency and commodity markets. For treasury teams, this necessitates a proactive approach to managing foreign exchange risks and renegotiating supplier contracts to mitigate potential financial shocks.

In addition to trade policies, the administration's focus on deregulation and tax reforms aims to stimulate domestic economic growth, as highlighted by J.P. Morgan Asset Management. While these measures may bolster U.S. corporate profitability, they also introduce inflationary pressures that could lead to higher interest rates. Treasury teams must remain vigilant in managing debt portfolios and interest rate exposures, particularly as the Federal Reserve signals a more hawkish stance in response to inflationary risks.

Furthermore, geopolitical tensions, including heightened trade disputes with China and ongoing global crises such as the Russia-Ukraine conflict, add layers of complexity to treasury operations. The Economist Intelligence Unit (EIU) forecasts a 2.7% global economic growth rate for 2025, led by U.S. resilience but offset by weaker momentum in Europe and China. Treasury teams must closely monitor these macroeconomic trends to anticipate potential impacts on cross-border cash flows, credit availability, and investment opportunities.

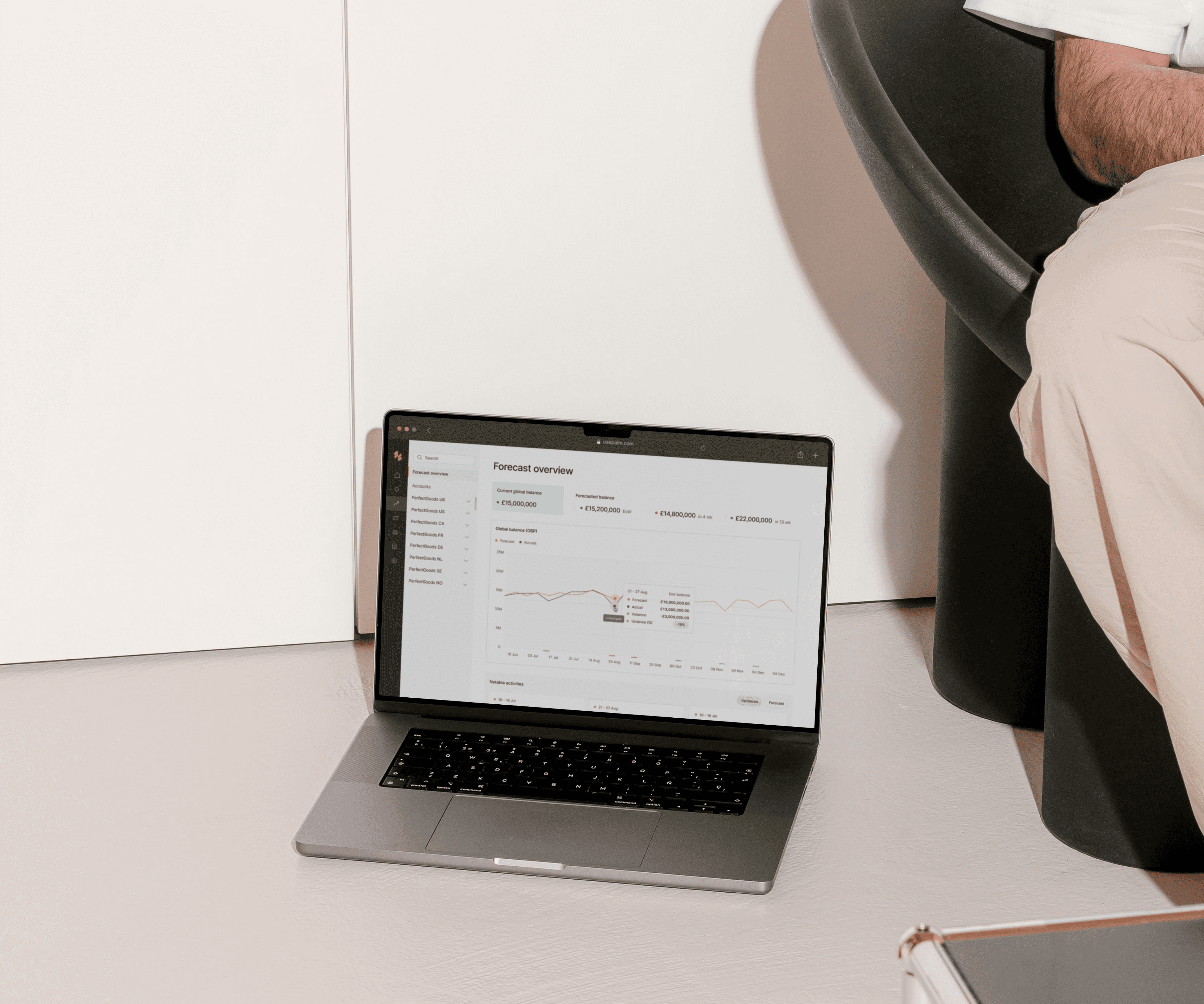

As businesses navigate this uncertain environment, corporate treasury teams are uniquely positioned to play a strategic role in mitigating risks and capitalizing on emerging opportunities. By leveraging advanced forecasting tools, enhancing liquidity management practices, and maintaining agility in decision-making, treasurers can help their organizations thrive amidst the challenges posed by the 2025 Trump presidency.

Impact of Trump's 2025 Trade Policies on International Corporate Treasury Operations

Increased Volatility in Currency Markets

The 2025 trade policies under President Trump, particularly the imposition of tariffs and renegotiation of trade agreements, have led to significant fluctuations in global currency markets. For corporate treasury teams, this has heightened the complexity of managing foreign exchange (FX) risk. The 25% tariff on imports from Mexico and Canada, as well as the proposed 60% tariff on Chinese goods, has caused sharp devaluations in the Mexican peso (MXN) and Chinese yuan (CNY), while the U.S. dollar (USD) has strengthened due to perceived safe-haven demand.

Treasury teams must now contend with increased FX hedging costs. For example, forward contracts and options to hedge against the peso and yuan have seen premiums rise by 15-20% since the tariffs were announced (PineBridge Investments). This increase in hedging costs directly impacts corporate liquidity and profitability, especially for firms with significant exposure to these currencies.

Moreover, the potential for retaliatory tariffs from trading partners has introduced further uncertainty. For instance, the European Union has signaled potential countermeasures, which could affect the EUR) and exacerbate currency volatility. Treasury teams must now adopt dynamic hedging strategies and scenario planning to mitigate risks associated with such unpredictable market movements.

Strained Liquidity Management Due to Tariff-Driven Cost Pressures

The introduction of sweeping tariffs has increased the cost of goods for companies reliant on international supply chains. This has directly impacted cash flow and liquidity management for corporate treasury teams. For example, companies in the automotive and electronics sectors, which heavily depend on imported components from Mexico, Canada, and China, have reported a 10-15% increase in production costs (Forbes).

Treasury teams are now tasked with optimizing working capital to counteract these cost pressures. This includes renegotiating payment terms with suppliers, accelerating receivables collection, and delaying payables where possible. However, such measures are not without risks, as they can strain supplier relationships and lead to disruptions in the supply chain.

Additionally, the increased cost of imported goods has led to higher inventory levels as companies stockpile to avoid future tariff hikes. This ties up significant cash reserves, further complicating liquidity management. Treasury teams must now balance the need for liquidity with the strategic imperative to maintain operational continuity.

Challenges in Cross-Border Cash Pooling and Repatriation

Trump’s 2025 trade policies have also impacted cross-border cash pooling and repatriation strategies. The introduction of tariffs and sanctions has led to regulatory changes that complicate the movement of funds across borders. For instance, the U.S. Treasury Department has tightened reporting requirements for cash transfers involving countries subject to high tariffs or sanctions, such as China (Clifford Chance).

These regulatory changes have increased compliance costs and administrative burdens for treasury teams. Companies with centralized cash management systems must now navigate a more fragmented regulatory landscape, which can delay cash repatriation and impact liquidity planning. Furthermore, the strengthened USD has made repatriating funds from foreign subsidiaries less favorable, as currency conversion losses erode the value of repatriated cash.

To address these challenges, treasury teams are exploring alternative cash management structures, such as regional cash pooling, to minimize regulatory hurdles and optimize liquidity. However, these structures require significant upfront investment and ongoing management, adding to the operational complexity for treasury teams.

Elevated Cost of Debt and Financing

The trade policies have also had a pronounced impact on the cost of debt and financing for corporations. The tariffs and associated trade tensions have contributed to rising inflationary pressures in the U.S., prompting the Federal Reserve to adopt a more hawkish monetary policy stance. As a result, interest rates have increased, leading to higher borrowing costs for companies (Fortune).

For treasury teams, this has necessitated a reevaluation of debt portfolios and financing strategies. Companies with variable-rate debt are particularly vulnerable, as rising interest rates increase their debt servicing costs. To mitigate this risk, treasury teams are increasingly turning to interest rate swaps and other derivatives to lock in fixed rates. However, the cost of these hedging instruments has also risen, further straining corporate budgets.

Additionally, the uncertainty surrounding trade policies has led to a widening of credit spreads, particularly for companies in trade-sensitive industries such as manufacturing and retail. This has made it more expensive for these companies to issue new debt or refinance existing obligations. Treasury teams must now work closely with financial institutions to secure favorable terms and ensure access to capital in a challenging financing environment.

Strategic Adjustments to Transfer Pricing and Tax Planning

The 2025 trade policies have also necessitated significant adjustments to transfer pricing and tax planning strategies for multinational corporations. The introduction of tariffs has altered the cost structures of cross-border transactions, requiring treasury teams to revisit their transfer pricing models to ensure compliance with evolving regulations (Grant Thornton).

For example, companies that import goods from high-tariff jurisdictions must now account for the increased cost of goods sold (COGS) in their transfer pricing calculations. This has implications for profit allocation across jurisdictions and can lead to higher tax liabilities in certain markets. Treasury teams must work closely with tax advisors to model the impact of tariffs on transfer pricing policies and implement adjustments to mitigate tax exposure.

Furthermore, the potential for retaliatory tariffs and trade restrictions has prompted companies to reevaluate their supply chain structures. Nearshoring and reshoring initiatives, while reducing tariff exposure, can have significant tax implications. Treasury teams must consider the tax benefits and drawbacks of such strategies, including the availability of tax incentives for domestic production and the impact on overall tax efficiency.

In addition to transfer pricing, the trade policies have also influenced tax repatriation strategies. The strengthened USD and increased compliance requirements have made it less attractive for companies to repatriate foreign earnings. Treasury teams must now explore alternative strategies, such as reinvesting earnings in foreign markets or utilizing tax-efficient structures to minimize repatriation costs.

Heightened Focus on Risk Management and Scenario Planning

The unpredictable nature of Trump’s 2025 trade policies has underscored the importance of robust risk management and scenario planning for corporate treasury teams. The potential for sudden policy shifts, such as the imposition of new tariffs or sanctions, requires treasury teams to adopt a proactive approach to risk management.

This includes conducting regular stress tests to assess the impact of various trade policy scenarios on liquidity, FX exposure, and financing costs. Treasury teams must also develop contingency plans to address potential disruptions, such as supply chain interruptions or regulatory changes. For example, companies with significant exposure to Chinese imports are exploring alternative sourcing strategies and building redundancy into their supply chains to mitigate the risk of future tariffs (YCharts).

Additionally, treasury teams are leveraging advanced analytics and technology to enhance their risk management capabilities. Tools such as predictive analytics and scenario modeling enable treasury teams to identify potential risks and develop data-driven strategies to address them. However, the implementation of these tools requires significant investment and expertise, which can be a barrier for smaller organizations.

In summary, Trump’s 2025 trade policies have introduced a range of challenges for international corporate treasury operations, from increased currency volatility and liquidity pressures to higher financing costs and tax complexities. Treasury teams must adopt a multifaceted approach to navigate these challenges, leveraging advanced risk management tools, dynamic hedging strategies, and proactive scenario planning to ensure financial stability and operational continuity.

Strategies for Corporate Treasury Teams to Mitigate Risks in a Volatile Geopolitical Landscape

Proactive Liquidity Contingency Planning

Corporate treasury teams must adopt advanced liquidity contingency frameworks to navigate the geopolitical uncertainties under the 2025 Trump administration. Unlike the existing focus on tariff-driven liquidity pressures, this section emphasizes the need for preemptive measures to address potential disruptions in cash flow caused by geopolitical tensions, such as the ongoing U.S.-China trade disputes or escalating conflicts in the Middle East.

Key strategies include:

Diversified Liquidity Sources: Treasury teams should establish diversified funding channels, including revolving credit facilities and access to international capital markets, to mitigate risks from localized disruptions. For example, companies with operations in Taiwan should secure alternative liquidity lines to counter potential supply chain interruptions due to geopolitical tensions with China. (Treasury Management International)

Dynamic Cash Flow Forecasting: Leveraging predictive analytics tools, treasury teams can model multiple geopolitical scenarios to anticipate liquidity needs. For instance, stress-testing scenarios involving heightened tariffs or sanctions can help identify vulnerabilities in working capital cycles.

Enhanced Cash Reserves: Maintaining higher cash reserves in safe-haven currencies like the U.S. dollar (USD) or Swiss franc (CHF) can provide a buffer against currency volatility and geopolitical shocks.

Strengthening Counterparty Risk Management

This section expands on the concept of risk management by focusing specifically on counterparty risks, which are exacerbated by geopolitical instability. Unlike the broader risk management strategies covered in previous reports, this section highlights the importance of evaluating the financial health and geopolitical exposure of counterparties.

Counterparty Credit Assessments: Treasury teams should conduct rigorous credit evaluations of counterparties, particularly those operating in regions affected by U.S. tariffs or sanctions. For example, suppliers in China or Russia may face financial strain due to trade restrictions, increasing the risk of payment defaults.

Geopolitical Risk Mapping: Mapping the geopolitical exposure of counterparties can help identify potential risks in the supply chain. For instance, companies reliant on semiconductor suppliers in Taiwan should assess the impact of potential disruptions due to tensions with China. (Banking Supervision Blog)

Mitigation Contracts: Treasury teams can negotiate mitigation clauses in contracts, such as force majeure provisions, to safeguard against geopolitical disruptions.

The 2025 Trump presidency has introduced a highly volatile and complex environment for international corporate treasury teams, driven by aggressive trade policies, regulatory shifts, and geopolitical uncertainties. Key challenges include heightened currency volatility due to tariffs, increased costs of FX hedging, and strained liquidity management as companies face rising production costs and supply chain disruptions. Treasury teams must also navigate a fragmented regulatory landscape, with stricter compliance requirements for cross-border cash pooling and repatriation, alongside elevated financing costs stemming from inflation-driven interest rate hikes. These factors collectively demand dynamic risk management strategies, advanced scenario planning, and greater operational agility.

The implications for treasury operations are profound. Liquidity management requires preemptive measures, such as diversified funding sources and enhanced cash reserves, to counteract tariff-driven cost pressures and geopolitical disruptions. Treasury teams must also adapt to evolving tax and transfer pricing frameworks, balancing nearshoring strategies with tax efficiency to mitigate tariff exposure.

To address these challenges, treasury teams should prioritize investments in advanced analytics, scenario modeling, and cybersecurity to enhance resilience. By adopting a multifaceted approach that integrates technology, strategic planning, and external expertise, treasury teams can mitigate risks, ensure financial stability, and position their organizations for long-term success.