Treasurers who have the budget and resources to implement a treasury system should view this as an opportunity to leave their legacy. A successful implementation creates a more effective and happier team that can manage treasury operations efficiently. We all know the negative effects a poor system implementation can have on a team. That's why dedicating time to find and plan the right solution for your business is crucial for success. The first major decision point is whether to build a custom solution in-house or partner with a suitable treasury SaaS provider to do the heavy lifting.

This blog explores tips to help you decide, along with important considerations you may not have thought of before deploying your hard-won tech budget.

The Problem: What Are You Trying to Solve?

Let’s start by defining the scope of the project. Is the primary goal of the software to automate cash forecasting, reduce risk, or simply to streamline operations? A well-selected solution should directly address the challenges you're facing.

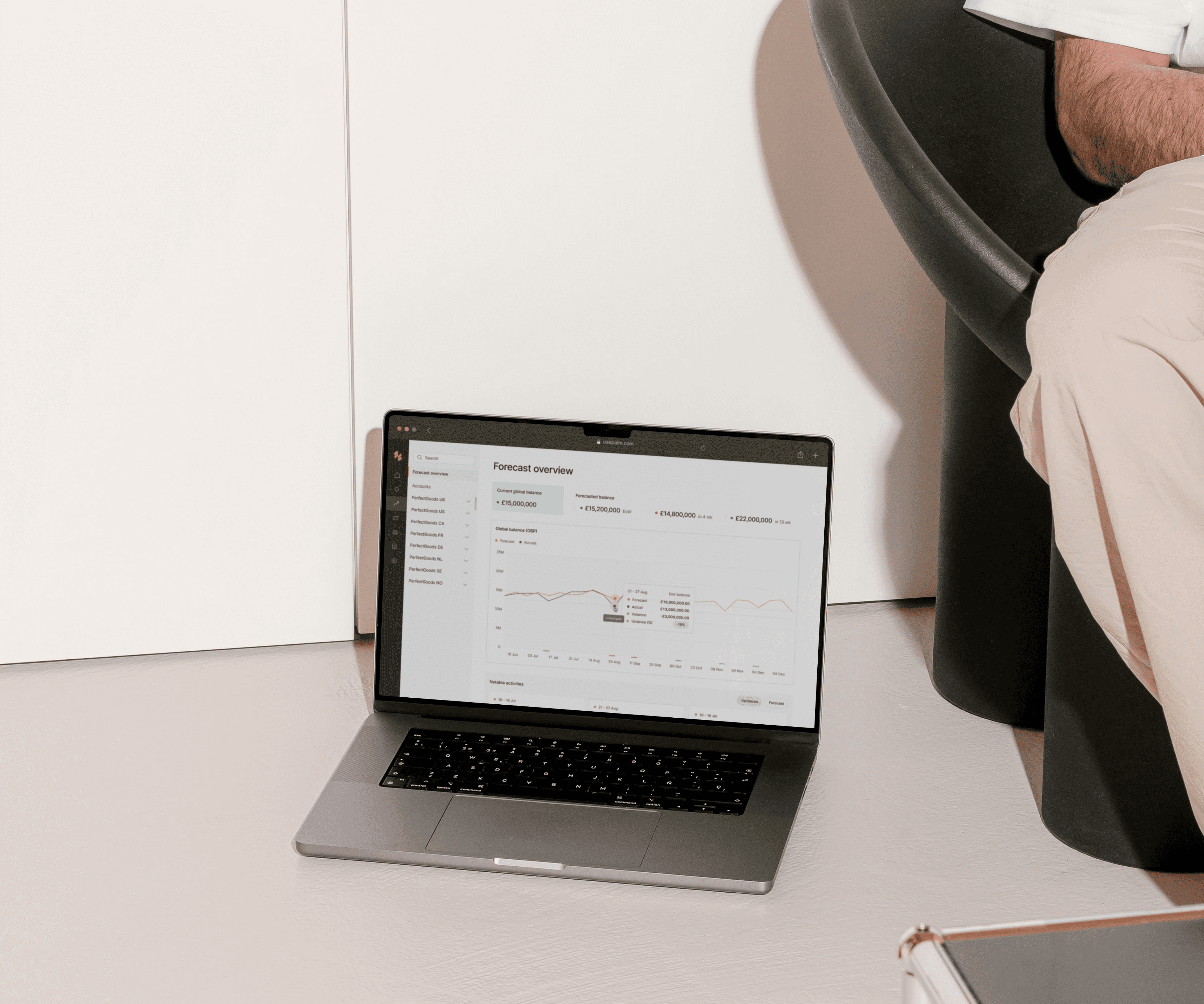

Are your challenges commonplace in the treasury industry and likely to be addressed by off-the-shelf software, or are they more bespoke? A treasury Saas solution can connect to your banks and offer pre-built features for cash management, liquidity forecasting, reconciliation, and bank account management, providing a quick path to operational improvements without the need for complex custom development. However in complex organisations, specifically those with a web of intercompany relationships, regulatory requirements and policies a custom built solution may be the only way to achieve the outcome you need.

A simple tool you can use to prioritise your scope requirement is the The MoSCoW Method commonly used by product managers developing new software.

Must-haves- The minimum requirements that you need from the tool, without which the project could not be deemed a success. Such as total cash visibility and bank connectivity.

Should-haves- Important features that are not critical to the project's success, but add substantial value. They are high-priority items that are not as time-sensitive as the Must-haves, such as real time cash statements vs. closing positions.

Could-haves- Desirable features that do not affect the overall project's success which can be included if time and resources permit.

Won't-haves- These are features that are not a priority for this specific time frame. They are agreed upon and recognised but are dropped for the project's current scope.

The Resources: What Do You Have Available?

When deciding whether to build or buy, you must evaluate the resources your team has at its disposal. This includes your budget, timeline, technical expertise, and the internal capacity to either develop or implement a new system.

Key Factors to Assess:

Time: How quickly do you need the solution? Custom-built systems can take months or even years to develop, while SaaS treasury software can be deployed in a number of weeks.

Budget: What is your budget for a new treasury system? Building your own solution involves significant upfront investment in development, infrastructure, and ongoing maintenance. Conversely, SaaS software typically offers a subscription-based pricing model that includes updates, support, and security features.

Team Expertise: Does your team have the skills and time to develop a custom solution, or would they be better focused on strategic treasury tasks?

Integration Needs: Do you need the new system to integrate with existing platforms such as your ERP, banking portals, or accounting software?

When answering these questions don’t just think about your state of play in the business right now. As this is a long term investment you need to consider where to business will be in 5 or 10 years time. In a large enterprise, budget squeezes are common to achieve shareholder targets, headcount today may not mean headcount tomorrow. The commitment of maintaining an in house solution in the long term maybe a challenge. Similarly in a fast moving company, changes of direction and priorities could similarly divert budget and resources elsewhere. Consider these possibilities when making your final decision to set up your team for the best possible outcome in the long term.

The Cost: What’s the ROI of Building vs. Buying?

Cost is one of the most important factors in deciding whether to build or buy your treasury solution. Consider the upfront costs, ongoing maintenance, and long-term ROI of each option.

Key Questions to Ask:

What is the total cost of ownership for both building and buying the solution?

How quickly will each option provide value to your treasury team?

Are there hidden costs such as ongoing support, maintenance, or software upgrades?

Example Scenario: Building vs. Buying

Here’s how the costs can compare:

Building In-House: Developing a custom cash management solution can be expensive and time-consuming. You’ll need to allocate a significant budget for development, testing, implementation, and future upgrades. A dedicated development team will need to be hired or reassigned, which can take focus away from other strategic initiatives. The time to see value from the solution is long, and there are also continuous costs associated with maintaining and updating the system. (

Buying an Out-of-the-Box SaaS Solution: In contrast, purchasing a subscription to a SaaS treasury software typically involves predictable subscription fees, which include both the software and support. The time to value is much shorter, as these systems are designed to be implemented quickly with minimal disruption. SaaS solutions also include ongoing updates and enhancements, so you don’t have to worry about the costs of keeping the system up-to-date.

Buying an out-of-the-box SaaS solution usually results in a faster ROI. You’ll also benefit from built-in customer support, ongoing updates, and no hidden costs for software enhancements. Plus, since the solution is subscription-based, you’ll have more flexibility to scale up or down as your needs change over time.

The Verdict: Build or Buy?

When choosing between building a custom solution or buying an off-the-shelf SaaS treasury software, the following factors should guide your decision:

Build In-House if:

Your treasury needs are highly specialised and cannot be met by available software solutions.

You have the technical expertise and resources to manage development, maintenance, and long-term support.

You need complete control over every aspect of the solution and are willing to invest significant time and capital in creating a fully tailored system.

Buy an Out-of-the-Box SaaS Solution if:

You require a solution with pre-built capabilities for cash management, liquidity forecasting, and bank reconciliation.

You need a quick-to-implement solution that minimises downtime and accelerates value realisation.

You prefer to reduce internal development costs and focus your team on strategic financial tasks instead of managing technology infrastructure.

You want a scalable, flexible solution that grows with your business and integrates seamlessly with your existing systems.

Frameworks to Help You Decide

Consider using the following frameworks to make your decision clearer:

Total Cost of Ownership (TCO): Evaluate the full financial picture of each option, considering both upfront and ongoing costs, including training, support, and system updates.

Time-to-Value: Assess how quickly each solution can be deployed and how soon you can start seeing measurable results. Buying an off-the-shelf SaaS solution typically offers a faster deployment timeline compared to custom development.

Value vs. Effort Matrix: Plot each requirement based on its value to the business against its complexity to implement, you can then decide whether for each requirement this would be better built as a custom solution or if it is readily available.

Wrap Up

The choice between building or buying cash management software is a critical one, and it ultimately depends on your organisation’s needs, resources, and long-term objectives. If you require a customised, specialised solution that addresses unique business needs and have the internal resources to manage it, building may be the best option. However, for most treasury teams, buying an out-of-the-box SaaS solution offers a more efficient, cost-effective, and scalable alternative that can deliver immediate value, reduce complexity, and allow your team to focus on strategic decision-making.