In an increasingly globalized business environment, effective cash management has become a cornerstone of financial efficiency for multinational corporations. Cash pooling, a financial mechanism that consolidates the balances of multiple accounts into a single master account, has emerged as a vital tool for optimizing liquidity, reducing costs, and enhancing operational flexibility. However, implementing a cash pooling structure across multiple countries and regions presents unique challenges, including regulatory compliance, tax implications, and operational complexities.

We’ll share the top strategies for establishing an efficient and compliant cash pooling structure, tailored to the needs of companies operating in diverse international markets. By leveraging advanced methodologies and understanding the nuances of different jurisdictions, businesses can unlock the full potential of cash pooling to streamline treasury operations and drive financial performance.

The Importance of Cash Pooling in International Operations

Cash pooling offers significant benefits for multinational companies by centralizing cash management. It enables businesses to reduce reliance on external financing, optimize interest income, and ensure better allocation of surplus funds. For example, hybrid cash pooling—a combination of physical and notional pooling—has gained traction as a flexible solution for companies with varying financial needs across subsidiaries. This model not only unlocks cash efficiency across multiple currencies and entities, but operationally allows companies to manage funding on dozens to hundreds of account while mostly managing one funding account.

Challenges in Cross-Border Cash Pooling

Despite its advantages, implementing cash pooling across multiple countries is far from straightforward. Each jurisdiction has distinct regulations governing fund transfers, exchange controls, and taxation. For instance, some countries impose restrictions on cross-border transfers or require specific approvals, which can complicate the pooling process. In China, recent enhancements to cross-border cash pooling policies by the People's Bank of China (PBOC) and the State Administration of Foreign Exchange (SAFE) have streamlined processes and reduced costs, making it a more attractive option for MNCs (UDF Space).

Moreover, legal and tax considerations, such as withholding taxes and thin-capitalization rules, must be carefully analyzed to ensure compliance. The choice of banking partners and technological platforms also plays a critical role in overcoming these challenges and achieving seamless integration of cash pooling systems (Euroaccounts).

The Need for Strategic Planning

To successfully implement a cash pooling structure, companies must adopt a strategic approach that aligns with their financial objectives and operational realities. This involves conducting a thorough analysis of liquidity needs, selecting the appropriate pooling model (physical, notional, or hybrid), and ensuring compliance with local regulations. Regular reviews and adjustments to the pooling strategy are essential to adapt to changing market conditions and regulatory landscapes

This blog aims to provide actionable insights and best practices for setting up and optimizing cash pooling structures across diverse regions. By addressing the complexities of cross-border operations and leveraging innovative solutions, businesses can enhance their financial resilience and maintain a competitive edge in the global marketplace.

Understanding Regulatory and Legal Considerations for Cash Pooling Across Regions

1. Navigating Country-Specific Cash Pooling Permissions

Cash pooling is not a one-size-fits-all solution. Each country has its own set of rules, and understanding these is akin to solving a Rubik’s cube blindfolded—challenging but doable with the right strategy. In some regions, cash pooling is fully permitted, while in others, it’s partially allowed or outright restricted. Anecdotally, Europe is a relatively relaxed environment for cash pooling and cross border sweeps with most major banking hubs offering products to corporates. In contrast, pooling in LatAm in Asia can prove to be more challenging. Although things are evolving.For instance, countries like Thailand have recently relaxed regulations, enabling onshore FX conversion, which allows USD balances to be pooled offshore (Standard Chartered). This move unlocked significant liquidity that would have otherwise been trapped locally.

In contrast, Vietnam is still deliberating the feasibility of intercompany loans, which are currently not permitted. Meanwhile, China continues to evolve its stance through pilot programs aimed at optimizing cross-border cash pooling for multinational corporations (Global Times). These pilot programs, rolled out in cities like Shanghai and Beijing, aim to streamline the pooling of both foreign and domestic currencies.

The choice of banking partner also plays a pivotal role in navigating these permissions. Some banks may have the required special permits, while others may not. For instance, Singapore and Malaysia have embraced innovative banking networks, such as direct debit systems, to simplify cash pooling (Standard Chartered).

2. Tax Implications: The Elephant in the Room

In cash pooling, tax authorities often view intercompany cash transfers as loans, which can trigger tax consequences. For instance, transfer pricing regulations may require that intercompany cash transfers be conducted at arm’s length, meaning you can’t just shuffle money around without proper documentation (Euroaccounts).

In Europe, tax implications are particularly pronounced due to the EU’s Anti-Tax Avoidance Directive (ATAD), which scrutinizes intercompany financial arrangements. Non-compliance can lead to penalties and increased tax liabilities. Similarly, in Asia, countries like India and China impose strict documentation requirements to ensure that cash pooling does not lead to tax base erosion.

Moreover, withholding taxes can complicate cross-border cash pooling. For example, if a subsidiary in Germany transfers funds to a parent company in the United States, withholding tax may apply unless a tax treaty provides relief. This makes it essential to consult tax advisors who specialize in international taxation (Tolley).

3. Legal Structures: The Foundation of Compliance

The legal structure of your organization can make or break your cash pooling strategy. Imagine building a skyscraper on a shaky foundation—it’s bound to collapse. Similarly, a poorly designed legal structure can lead to compliance nightmares. For instance, undercapitalization of subsidiaries can raise red flags for regulators, as it may indicate that cash pooling is being used to siphon funds rather than optimize liquidity (Stahr Advisory).

In China, the People’s Bank of China (PBC) and the State Administration of Foreign Exchange (SAFE) have specific requirements for cross-border cash pooling, including minimum capital thresholds and detailed reporting obligations (Global Times). Similarly, in the United States, the Dodd-Frank Act imposes stringent requirements on intercompany financial arrangements to prevent systemic risks.

Choosing the right type of cash pool—physical or notional—also impacts legal compliance. Physical pools involve actual fund transfers, which are subject to local banking and foreign exchange regulations. Notional pools, on the other hand, involve virtual fund consolidation and may require special permissions in certain jurisdictions (Tolley).

Selecting and Implementing the Right Cash Pooling Model

Assessing Financial Needs and Organizational Structure

Before diving headfirst into the world of cash pooling, companies must first take a deep breath and assess their financial needs. This isn't just about counting the pennies (or euros, or yen, or whatever currency you're juggling); it's about understanding the liquidity requirements of each subsidiary and the overall financial health of the organization.

For instance, a company with subsidiaries in high-growth markets may need a model that prioritizes flexibility, while a more stable operation might focus on cost efficiency. A thorough analysis of cash flow patterns, borrowing needs, and surplus funds is essential. This step also involves evaluating the organizational structure—are we talking about a centralized treasury or a decentralized one? The answer will heavily influence the choice of cash pooling model.

Choosing Between Physical and Notional Cash Pooling

As a refresher, the two common pool setups are:

Physical Cash Pooling: This model involves the actual transfer of funds from subsidiary accounts to a central account. It's great for direct liquidity management but comes with higher transaction costs and potential regulatory hurdles.

Notional Cash Pooling: Here, the funds stay put, but the bank calculates interest based on the consolidated balance. It's like having a virtual piggy bank that magically knows how much everyone has saved. This model is ideal for companies looking to avoid the complexities of cross-border cash movements. However, it often requires cross-guarantees and a strong relationship with your bank. (Euroaccounts)

Exploring the Hybrid Approach: The Best of Both Worlds

Why choose between physical and notional when you can have both? Hybrid cash pooling combines the operational flexibility of notional pooling with the liquidity optimization of physical pooling. Sweeping funds via phyisical pooling into central accounts that sit in a notional pool can be a very powerful way of both optimizing cash balances and allowing for more a higher level of autonomous liquidity management for treasury teams.

Navigating Regulatory and Tax Implications

Implementing a cash pooling system requires a deep dive into the legal and tax frameworks of each country involved. This isn't just about ticking boxes; it's about avoiding penalties and risk that overshadow the expected benefits.

Key considerations include:

Transfer Pricing: Ensure that intercompany transactions are priced at arm's length to avoid scrutiny from tax authorities. This is especially crucial in notional pooling, where interest calculations can get tricky.

Withholding Taxes: Some countries impose taxes on cross-border interest payments, which can complicate physical pooling arrangements.

Capital Controls: In countries with strict exchange controls, moving funds across borders can feel like navigating a minefield. Regulatory compliance assessments should be a regular feature of your cash pooling strategy. (LinkedIn)

Leveraging Technology for Seamless Integration

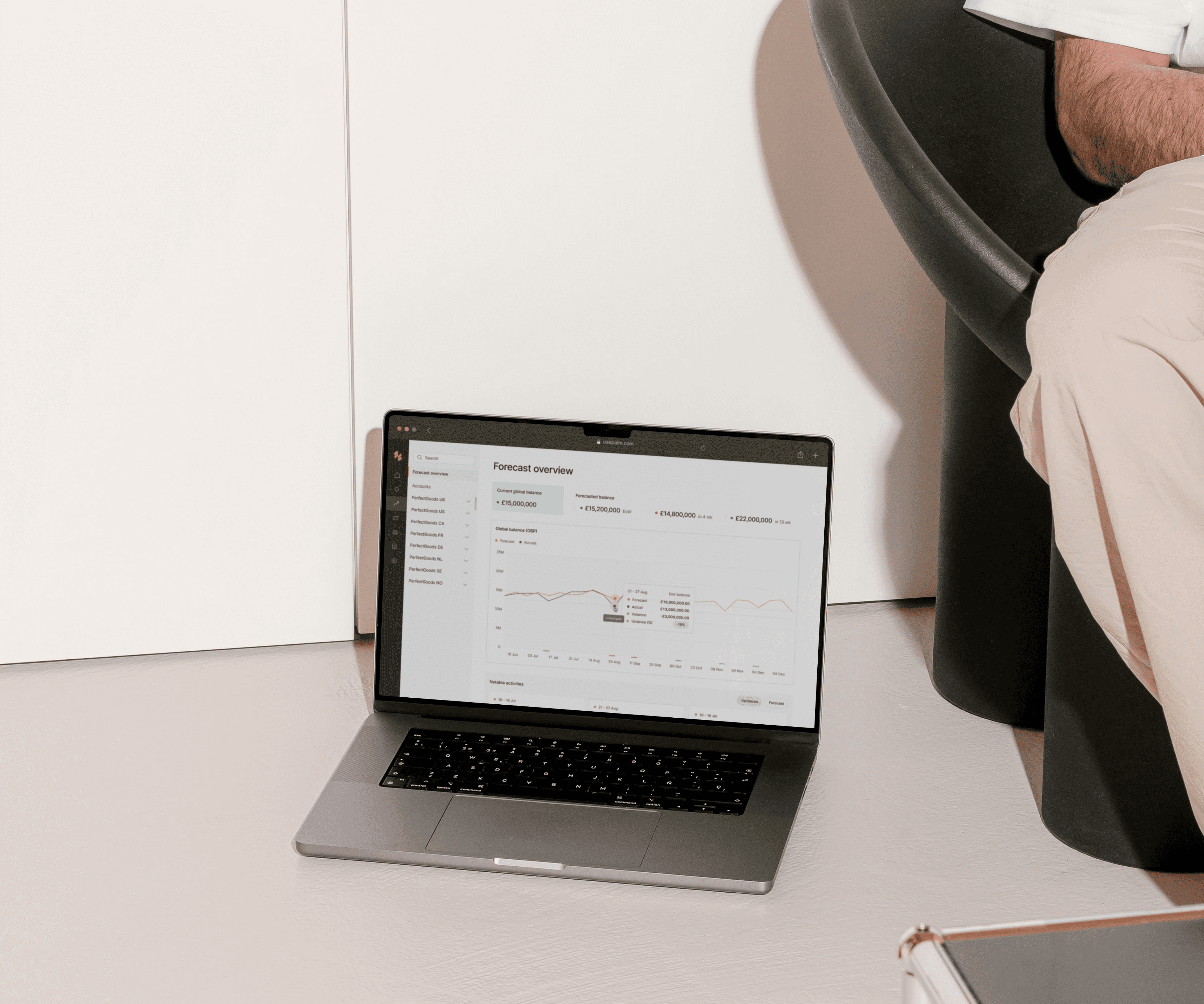

Managing a cash pool without the right technology also exposes treasury teams to additional unforeseen complexities. Modern treasury systems are designed to handle the complexities of cash pooling, from real-time balance tracking to automated interest calculations.

When selecting a TMS, look for features like:

Multi-Currency Support: Essential for companies operating across multiple regions.

Integration Capabilities: Your TMS should play nice with your existing ERP and banking systems.

Pool and Intercompany Balance Management: Especially with multi-entity physical pools, its important to understand when the balances reach or exceed targets that go against the spirit of the pooling setup (requiring converting balances to equity or deemed dividends for example)

Investing in the right technology not only simplifies operations but also provides the agility needed to adapt to changing market conditions.

Periodic Reviews and Adjustments

Cash pooling isn't a "set it and forget it" kind of deal. Market conditions, business needs, and regulatory landscapes are constantly evolving, and your cash pooling strategy should evolve with them. Regular reviews can help identify inefficiencies, ensure compliance, and keep your technology up to date.

Consider conducting:

Financial Audits: To spot inefficiencies and optimize liquidity or optimise credit limits with banks.

Regulatory Assessments: Especially crucial when entering new markets.

Technology Reviews: To ensure your tools are still fit for purpose.

By keeping your strategy dynamic, you can ensure that cash pooling remains a competitive advantage as your company grows.

Optimizing Cash Pooling Through Technology

Harnessing AI and Automation for Cash Pooling Efficiency.

While previous reports have touched on technology integration, this section delves deeper into the transformative role of AI and automation in cash pooling. Unlike traditional treasury management systems, AI-driven platforms have an opportunity to proactively inform teams of changes to business flows or trends. For instance, AI-powered tools can analyze historical data to forecast liquidity requirements across subsidiaries and recommend fund allocation after monitoring external factors that may drive changes that divert from historical trends.

Automation, on the other hand, eliminates manual processes, reducing errors and speeding up intercompany transactions. For example, automated triggers can initiate physical transfers only when a subsidiary’s balance dips below a predefined threshold, minimizing idle cash.

Moreover, APIs are revolutionizing connectivity between banks and corporate systems. Banks offering API-driven solutions provide real-time updates on account balances, enabling companies to make instantaneous decisions. This is a step up from the previously discussed integration capabilities of systems that typically relay on T+1 data, as APIs allow for seamless, real-time data exchange. (TietoEVRY)

Dynamic Target Balances: A Game-Changer for Cash Pooling

Unlike static target balancing that lacks flexibility, dynamic target balancing adjusts in real-time based on market conditions and operational needs. This approach ensures that cash pooling models remain aligned with business priorities, even as they evolve. For example, during periods of economic uncertainty, dynamic balancing can allocate more funds to subsidiaries in high-growth markets while tightening liquidity in stable regions.

This strategy is particularly beneficial for hybrid cash pooling models, where financial needs can vary significantly between subsidiaries. By integrating dynamic target balancing into cash pooling systems, companies can maintain operational flexibility without compromising on cost efficiency.

Continuous Improvement Through Data Analytics

Advanced analytics tools can identify patterns and trends that might not be immediately obvious, such as seasonal fluctuations in cash flow or recurring inefficiencies in fund allocation. For instance, analytics can reveal that a subsidiary in a high-growth market consistently runs a deficit during Q4, prompting the treasury team to adjust the cash pooling strategy accordingly. This goes beyond the financial audits mentioned earlier, offering a data-driven approach to decision-making.

Conclusion

Establishing an effective cash pooling structure across multiple countries and regions requires a strategic approach tailored to a company’s financial needs, organizational structure, and regional regulatory environments. The research underscores the importance of selecting the appropriate cash pooling model—whether physical, notional, or hybrid—based on liquidity requirements, operational flexibility, and cost efficiency. Physical pooling offers direct liquidity management but faces higher transaction costs and regulatory challenges, while notional pooling simplifies cross-border cash management but necessitates robust banking relationships and cross-guarantees. Hybrid models, combining the strengths of both, emerge as a versatile solution for companies with diverse and evolving financial needs, particularly in international operations.

Key considerations such as regulatory compliance, tax implications, and technological integration are critical to the success of any cash pooling strategy. Transfer pricing, withholding taxes, and capital controls must be meticulously managed to avoid financial penalties and ensure compliance with local laws. The adoption of advanced treasury systems, AI-driven platforms, and APIs enhances operational efficiency by enabling real-time monitoring, dynamic target balancing, and seamless integration with banking systems. It is worth noting, however, that not all banks provide all or any of these services. Please check with your partner banks before diving into the non-technical details mentioned here.

Regular reviews of cash pooling structures, supported by predictive analytics and real-time reporting, ensure resilience amidst market volatility and regulatory changes. As businesses expand globally, the integration of innovative tools and sustainable practices will not only optimize liquidity management but also position companies as forward-thinking leaders in financial stewardship.