The economic landscape is shifting rapidly as central banks in the EU, UK, and US take steps to lower interest rates in response to moderating inflation and subdued growth. For treasurers, these moves present both challenges and opportunities. This blog explores the latest market developments and provides actionable strategies for optimising cash management in a falling interest rate environment.

Market Update: Interest Rates on the Decline

UK: Balancing Growth and Persistent Risks

The Bank of England (BoE) faces a complex dynamic. Inflation has eased, prompting speculation about imminent rate cuts, but BoE policymakers remain divided. This move reflects a cautious stance, with the Monetary Policy Committee voting 8-1 in favour of the cut. Governor Andrew Bailey has hinted at aggressive cuts if inflation continues to fall, emphasising the importance of rates remaining “restrictive for sufficiently long”. While Catherine Mann, who voted to hold rates, has a more cautionary view of inflation, similarly to Chief Economist Huw Pill. The UK government’s fiscal stimulus plans add another layer of complexity, with potential implications for inflation and borrowing costs. Treasurers should anticipate further cuts, albeit with a measured approach.

EU: Disinflation on Track Amid Policy Adjustments

The ECB has adopted a more proactive approach, implementing back-to-back rate cuts for the first time since 2011. Following its latest 25-basis point cut, the ECB signalled a move dovish tone prioritising economic growth over inflation concerns. October’s rate cut by 25 basis points to 3.25%, signals confidence in a sustained disinflationary trend. This marked a shift from earlier indications of a policy pause, driven by weaker Purchasing Managers’ Index (PMI) data and inflation dropping to 1.7%. Speculation about a larger December cut has diminished after inflation ticked up to 2% in October. The ECB remains steadfast in its data-driven approach, balancing economic fragility with a commitment to taming inflation.

US: Gradual Cuts Amid Mixed Signals

The Fed has also signalled a cautious easing path. October’s data revealed a slowdown in job growth and persistent disinflationary trends, with the annual consumer price index easing to 2.4%. However, resilience in consumer demand and the services sector has kept the Fed on a moderate trajectory, avoiding aggressive cuts.

The Fed’s focus remains on gradual adjustments to ensure a stable economic environment, especially given geopolitical uncertainties that could influence global markets.

Implications for Treasurers: Turning Challenges into Opportunities

Falling interest rates inevitably compress yields on cash holdings, making it more difficult for treasurers to generate meaningful returns from idle cash. However, this environment also creates an opportunity to rethink cash management strategies. Below are 5 key considerations for optimising treasury operations:

1. Enhance Cash Flow Forecasting

Effective cash flow forecasting is critical in a low-rate environment. By improving accuracy in predicting short-term liquidity needs, treasurers can minimise idle cash and allocate surplus funds more effectively. Medium to long term forecasts can open the opportunity to lock excess funds away for longer periods and achieve higher yields. Leveraging advanced forecasting tools and integrating real-time data can improve the efficiency of the forecast production, leaving you more time to make investment decisions.

2. Reassess Investment Policies

As yields on traditional cash instruments like money market funds decline, treasurers should reassess their investment policies. Consider diversifying into slightly longer-term or higher-yielding instruments, such as short-duration bonds or high-quality commercial paper, while maintaining a robust risk management framework.

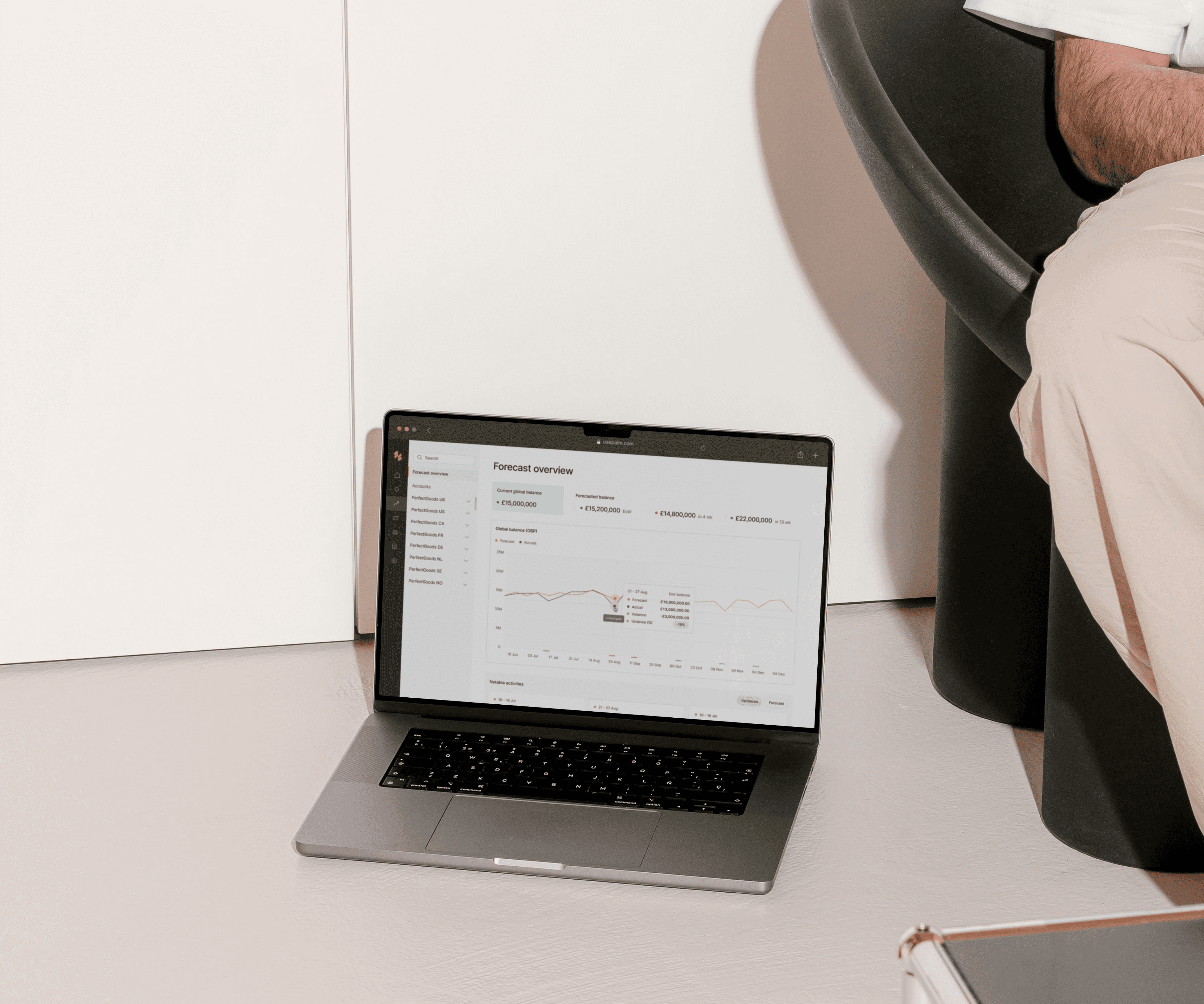

3. Leverage Technology for Liquidity Management

Modern cash management solutions offer the ability to centralise and optimise liquidity across multiple accounts and regions. Solutions like Palm can enable treasurers to access real-time insights to ensure excess cash is effectively utilised without compromising liquidity.

4. Explore Strategic Partnerships

Collaborating with banks or fintech partners can unlock innovative solutions for cash optimisation. Some providers offer dynamic deposit products or tailored investment options that align with a company’s risk tolerance and liquidity needs. Having this conversation with your bank frequently, will keep you up to date with their latest offerings and rate cards.

5. Optimise Working Capital

Streamlining accounts receivable and payable processes can reduce the cash conversion cycle and free up additional liquidity. Treasurers should work closely with operational teams to identify opportunities for early payment discounts or extended payment terms with suppliers.

Looking Ahead: Strategic Agility in Uncertain Times

While the trajectory of interest rate cuts seems clear for the remainder of 2024, the pace and depth of adjustments in 2025 remain uncertain, particularly amid geopolitical tensions and potential economic shocks. Treasurers must remain agile, continuously reassessing their cash management strategies to adapt to evolving market conditions.

Falling interest rates do not have to translate into diminished returns on cash. With proactive planning and the right tools, treasury teams can mitigate the impact of rate cuts, ensuring their organisations maintain liquidity, stability, and profitability.

Palm empowers treasurers to navigate these challenges with confidence. By offering innovative solutions tailored to a dynamic treasurers, Palm helps you optimise your cash management and stay ahead in an increasingly complex financial landscape.