Treasury operations can be a source of frustration for businesses. Board decisions depend on accurate cash flow data and reliable forecasts to make decisions, and treasury professionals are constantly under pressure to balance priorities and produce results.

Some obstacles arise from complex, structural data issues with no obvious fixes. But more often, outdated systems and suboptimal resource allocation are to blame. Addressing these inefficiencies starts with identifying the root problems and taking actionable steps to overcome them.

In this blog, we investigate what organisations need most from their treasury teams and how efficient treasury processes can empower companies to make more informed decisions. We'll also look at strategies for streamlining cash flow management, improving forecasting, and optimising bank account structures.

The Traditional Treasury

The core function of treasury has traditionally been to manage cash and ensure liquidity. This includes maintaining enough cash on hand to meet obligations, managing bank accounts, and ensuring that payments and receipts flow smoothly. For many businesses, the treasury team's role is behind-the-scenes operation that is largely unseen.

If cash flow is steady, bank reconciliations are seamless, and forecasts align with expectations, then treasury is considered to be doing its job. However, this traditional view is no longer sufficient.

Today, treasury operations are expected to drive strategic insights. Modern treasury teams are tasked with delivering real-time data, actionable forecasts, and risk management strategies that support growth and financial stability.

What Are Treasury Operations?

Treasury operations encompass more than just managing cash and accounts. Modern treasury teams are hybrid operators who leverage technology to implement systems and processes that ensure the business has strong financial hygiene. They combine technical skills with strategic oversight to make cash flow management, forecasting, and liquidity optimisation as efficient as possible.

For example, a treasury professional might:

Implement cash flow forecasting tools to predict short-term liquidity needs.

Optimise banking structures to minimise fees and streamline payments.

Integrate treasury management systems (TMS) with ERP platforms for real-time data visibility.

Advancements in technology have made it easier than ever to automate repetitive tasks, such as reconciling bank transactions or updating cash flow models. This shift allows treasury professionals to focus on value-added activities like scenario planning and liquidity risk management.

Barriers to Effective Treasury Processes

If your business struggles with slow cash flow reporting or inaccurate forecasts, two key issues are likely at play: outdated systems and a mismatch of skills within the treasury function.

Outdated Systems and Processes

Legacy Treasury Management Systems often lack the integrations and automation capabilities required for modern treasury operations, not embracing the latest technology like AI and current machine learning models. Manual processes, such as downloading bank statements and updating spreadsheets, are time-consuming and prone to error. Organisations stuck in these cycles will find it difficult to keep the forecast up to date in a timely manner.

Skills Gaps

Treasury operations require a combination of technical expertise and strategic thinking. Data analysis capabilities are becoming increasingly demanded of treasurers as they grapple with growing data sources and formats. Having access to strong IT resources is helpful, however it is the combination of the treasury expertise with the technical skills which is where the magic happens.

Steps to Improve Treasury Operations

Improving treasury operations begins with identifying bottlenecks and inefficiencies. Here’s how to get started:

1. Diagnose the Problem

The first step is to assess your current processes. Where are the pain points? Are manual reconciliations taking up too much time? Is your cash flow forecast inaccurate or outdated? Map out your treasury workflows and identify tasks that consume the most resources.

2. Leverage Technology

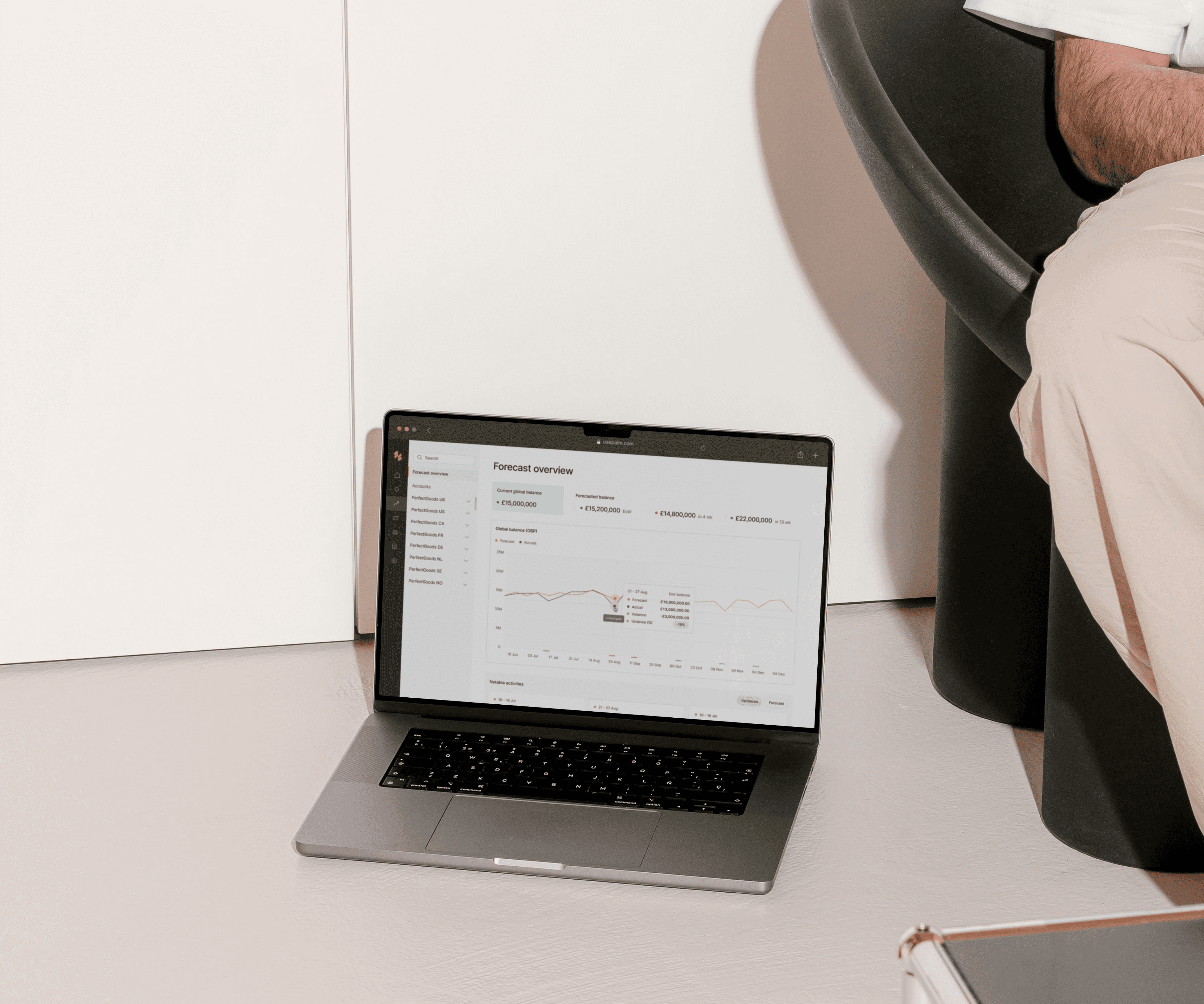

Look for opportunities to automate repetitive tasks. Cash management platforms such as Palm can help to automate cash positioning, forecast updates, and reporting. Ensure that your systems are integrated to allow real-time data flow between your ERP, bank portals, and other platforms.

For example, implementing a Cash Management Solution that integrates with your bank accounts can reduce the time spent on payment processing and cash reporting by providing a single, real-time view of all transactions.

3. Optimise Bank Account Structures

Many corporations suffer from overly complex banking structures with too many accounts spread across multiple institutions. Consolidating accounts and implementing sweeping arrangements can reduce fees and simplify liquidity management.

4. Focus on Forecasting

Accurate forecasting is essential for proactive decision-making. Invest in tools and processes that allow you to model various scenarios, such as changes in revenue or unexpected expenses. This will help ensure you maintain adequate liquidity while minimising idle cash.

The Role of Integrated Treasury Tools

One hallmark of efficient treasury operations is seamless data integration. Treasury tools should work together to provide a unified view of cash flow, liquidity, and risk. For example:

Cash Flow Forecasting Tools: Automatically pull data from other TMS systems and bank accounts to provide up-to-date projections.

Cash Management Platforms: Serve as a central hub for managing forecasts, reporting, and cash positions.

TMS & Bank Integration: Enable treasury to align cash management with broader financial and operational planning.

Free Up Time & Unlock Value

Improving treasury operations is not just about cutting costs or automating processes. It’s about empowering your company with the tools, data, and insights needed to make informed financial decisions. By rethinking your approach to cash flow management, forecasting, and bank account structures, you can transform treasury into a strategic asset that drives growth.

If inefficiencies are holding you back, now is the time to act. Start by diagnosing your processes, invest in the right technology, and ensure your team has the skills needed to manage a modern treasury function. With these steps, you’ll be well on your way to building a treasury operation that supports success.