Introduction

Treasurers face the constant challenge of managing cash flow, liquidity, and risk. The need for real-time visibility into cash balances and transactions has never been more business-critical. This blog post explores the benefits of bank connectivity, why it’s essential for treasurers, and how leveraging technology can transform your treasury operations.

Discover how enhanced connectivity can streamline your processes, reduce manual work, and empower your team to make data-driven decisions. We’ll cover various connection methods, the significance of cash visibility, and how Palm's advanced solutions can help you achieve seamless bank connectivity.

Why Do Treasurers Crave Bank Connectivity?

Treasurers are the backbone of any organisation, responsible for managing cash flow, liquidity, and financial risk. With multiple accounts spread across various financial institutions, having a consolidated view of cash positions is key. It allows treasurers to optimise cash management, avoid unnecessary debt, and make informed investment decisions.

In today’s digital age, traditional methods of bank communication are no longer sufficient. Treasurers crave connectivity because it provides the speed, accuracy, and efficiency needed to stay ahead. By connecting directly to banks, treasurers can automate data retrieval, reduce errors, and ensure that they always have the latest information at their fingertips.

Why Cash Visibility = Efficiency

Visibility into cash balances is a game-changer for treasury teams. It eliminates the need for manual data collection and reconciliation, freeing up time for more strategic tasks. With consistent and unified access to cash positions, treasurers can swiftly respond to changes in the financial landscape, ensuring that the organization remains agile and resilient.

Efficiency is not just about saving time; it’s about making better decisions. When treasury teams have accurate and up-to-date information, they can identify trends, forecast cash flow more accurately, and mitigate risks. Enhanced visibility also fosters collaboration within the team, as everyone has access to the same data and can work towards common goals.

Why Do Some Treasury Teams Still Rely on Manual Reports?

Despite the clear advantages of bank connectivity, some treasury teams continue to lean on manual reporting methods. One significant barrier is the lack of technical support to implement new systems. Many organisations may not have the internal resources or expertise to set up automated solutions, leaving teams to rely on traditional methods that are more familiar but less efficient.

Another prevalent concern is the belief that enhancing connectivity will incur prohibitive costs. Budget constraints can make it daunting for treasurers to invest in new technologies, leading them to continue with the status quo instead of seeking innovative solutions that could ultimately save money in the long run.

Lastly, time constraints play a crucial role in this reliance on manual reporting. Treasury teams are often inundated with day-to-day operations, making it challenging to allocate time for evaluating and deploying new systems. The pressure to maintain ongoing operations can overshadow the potential benefits of transitioning to automated processes, thus perpetuating a cycle of inefficiency. Ultimately, addressing these concerns is vital in helping treasury teams embrace the transformative

How Can You Connect to Your Bank to Retrieve Data?

Host to Host

Host-to-host connectivity is a direct link between your treasury management system (TMS) and the bank’s servers. This very common method is highly secure and reliable, allowing for the seamless transfer of files and data. It is ideal for organizations with high transaction volumes, as it ensures that data is transmitted efficiently.

Bank statements are sent in standardized file formats such as MT940, BAI, and Camt.053. The challenge however, is that bank branches may leverage differing fields within the format which results in inconsistencies when creating reconciliation or mapping rules to translate the data.

Host to Host files are typically delivered on a schedule, which also limit the ability to receive and send information in real time.

Setting up host-to-host connectivity requires technical expertise and coordination with the bank’s IT team. However, once established, it offers a robust and scalable solution for real-time data exchange. Treasurers can benefit from automated file transfers, reducing the need for manual intervention and minimizing the risk of errors.

Electronic Banking Internet Communication Standard (EBICS)

EBICS is a standardized protocol for electronic banking that allows the secure transfer of large files and data between banks and businesses. It supports various file formats such as XML, SWIFT MT messages, and EDIFACT. EBICS also offers multiple security features such as digital signatures and encryption to ensure the confidentiality of data.

EBICS is not a widely used protocol, so international treasury team will need to be mindful of whether their bank supports before proceeding.

SWIFT Connectivity

Larger corporates may choose to use their own SWIFT connectivity. This enables them to connect directly with their banks via SWIFT messaging. This method is highly secure and standardised, providing real-time access to bank balances, statements, and transaction status updates.

However, setting up a SWIFT connection requires significant resources and expertise. It can also be costly for smaller organizations that may not have the volume of transactions to justify the investment. For these reasons, SWIFT connectivity is more commonly used by large corporations with complex international cash management needs.

API

APIs (Application Programming Interfaces) are revolutionising bank connectivity. They enable real-time data exchange between systems, providing instant access to account balances, transaction details, and other critical information. APIs are flexible, easy to integrate, and can be tailored to meet specific business needs.

Using APIs, treasurers can create customised dashboards, automate workflows, and gain actionable insights. The real-time nature of APIs means that treasurers can make decisions based on the latest data, enhancing their ability to manage cash flow and liquidity effectively.

However, not all APIs are created equal and treasurers will need to be mindful of the APIs they choose to leverage to support the business . We will cover the key differences here.

Connectivity Partners

For organisations that lack the technical resources to implement direct connections, partnering with a connectivity provider can be an excellent solution. These providers offer comprehensive services that include setting up and maintaining connections, ensuring data security, and providing support.

A connectivity partner can bridge the gap between your treasury system and the bank, offering a seamless and hassle-free way to access data. They handle the complexities of integration, allowing treasurers to focus on strategic activities. Additionally, partners often provide value-added services such as data enrichment and analytics.

How Palm Can Help You Achieve Seamless Bank Connectivity

At Palm, we understand the challenges faced by treasury teams in managing multiple banks and bank accounts in achieving real-time visibility into cash positions. Our advanced solutions offer seamless connectivity with various banks

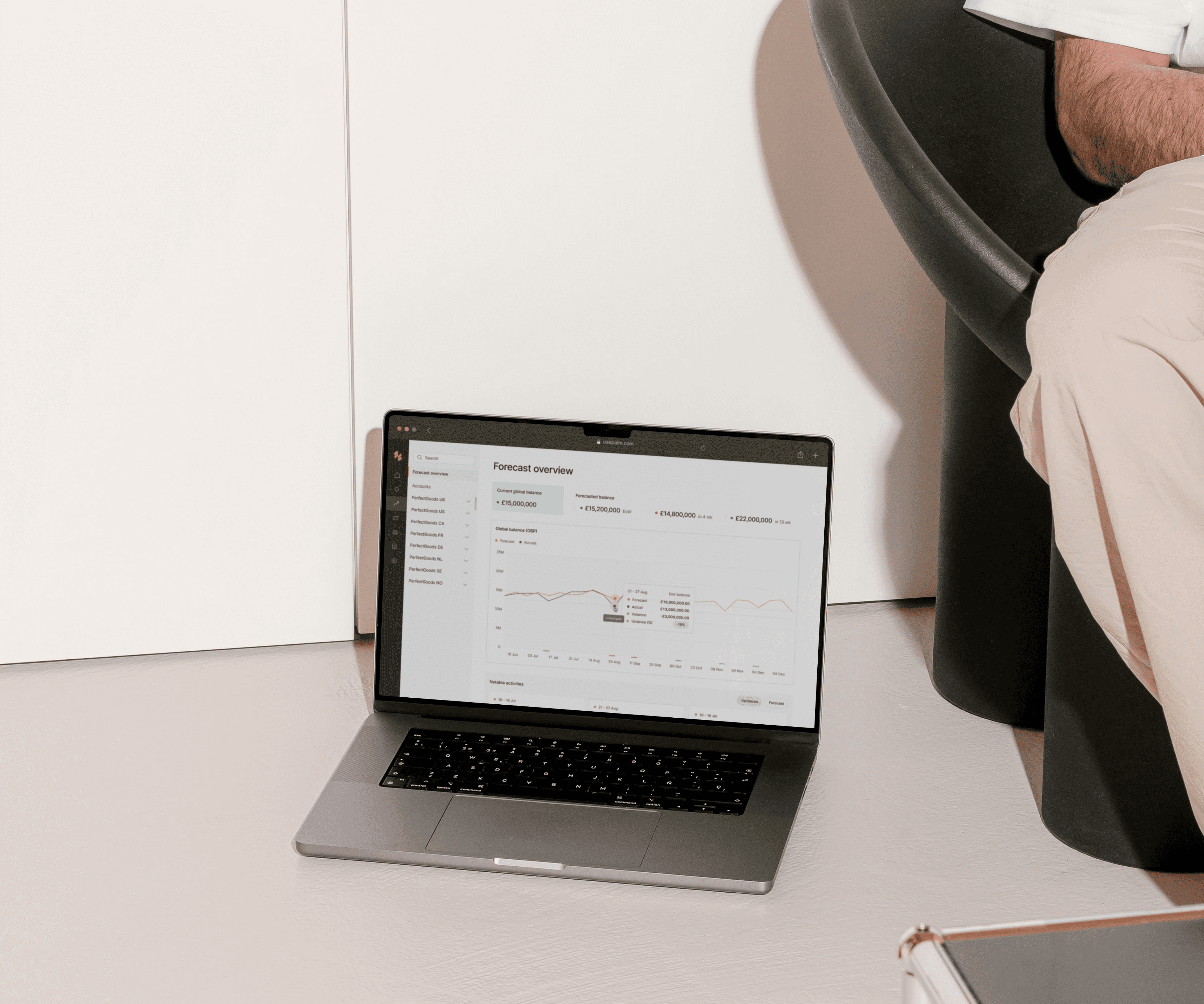

Palm leverages advanced API technology to connect seamlessly with banks. This connectivity provides real-time access to account balances, transaction details, and more. With Palm, you can integrate data from multiple banks into a single platform, offering a unified view of your finances.

Palm also supports banks that are still transitioning to APIs, by accepting host-to-host and EBICS protocols.

Automatic transaction and balance refreshes to suit your business

Palm’s automated processes ensure that your account balances and transactions are updated overnight or real-time. This means you start each day with the most accurate and current information, enabling you to make timely decisions. The automatic refresh eliminates the need for manual updates, saving time and reducing the risk of errors.

No Need for Technical Support to Implement Palm

One of the key advantages of using Palm for bank connectivity is its user-friendly approach to integrations that eliminates the need for extensive technical support during implementation. Treasurers can easily set up and manage connections without relying on IT teams or external expertise. This accessibility not only accelerates the onboarding process but also empowers treasury professionals to take control of their cash management solutions. With straightforward tools and guided setup processes, Palm ensures that organisations can swiftly harness the power of real-time data without the complexities often associated with technology integration. This allows treasury teams to focus on what they do best—making informed financial decisions and optimising cash flow.

Categories Transactions into Forecast Categories

Palm’s intelligent system categorises transactions into your chosen forecast categories, providing valuable insights into your cash flow. This categorisation helps treasurers identify trends, plan for future needs, and optimise cash management. With Palm, you can transform raw data into actionable information, enhancing your ability to manage finances effectively.

Conclusion

Bank connectivity is no longer a luxury; it’s a necessity for treasurers and CFOs looking to optimize their operations. By leveraging technology and adopting modern connectivity methods such as host-to-host and APIs, treasurers can transform their treasury operations. Enhanced cash visibility, streamlined processes, and data-driven decision-making are just some of the benefits that come with seamless bank connectivity. With Palm's advanced solutions, treasurers can stay ahead of the curve and drive value for their treasury teams.

Investing in solutions like Palm can transform your treasury operations, reducing manual work and empowering your team to focus on strategic activities. Don’t wait to experience the advantages of seamless bank connectivity. Explore how Palm can help you achieve your financial goals and book a demo today to see our solutions in action.