When regurgitating the cash flow forecast week in and week out, it is easy to become stuck in a rut, producing the same information in the same format and with the same shortfalls. Although the importance of the forecast on the rest of the business doesn’t waiver, the focus from the treasurer to strive for improvements and iterations inevitably does.

In this post, I pose some questions to you as a treasurer to prompt you to think about your forecast and whether it’s time for a refresh.

What am I trying to achieve with this forecast?

Before you get into the details, take a step back and think about the big picture. What’s the purpose of this forecast? Are you focused on short-term liquidity, preparing for long-term investments, or supporting strategic decisions like mergers or acquisitions? Having a clear objective in mind will help you avoid gathering unnecessary data and focus on what truly matters.

Defining your goals upfront also helps you ensure your forecast is aligned with the needs of key stakeholders, like the CFO or the board of directors.

Do I have access to reliable data?

Your forecast is only as good as the data you’re working with. Ask yourself if you have access to the most up-to-date and accurate information, whether it’s from your internal systems or external sources. Real-time cash positions, accounts receivable and payable, and working capital data are all critical to producing an accurate forecast.

If you’re working with outdated or incomplete data, it’s likely to throw off your forecast—and your ability to make informed decisions.

Are other departments providing quality inputs?

Treasury doesn’t work in a silo. A strong cash flow forecast relies on input from across the business—sales, procurement, finance, and more. Are you getting timely and accurate data from those teams? It’s important to establish open lines of communication with other departments and verify the quality of the data they provide. After all, if their numbers are off, your forecast will be too.

It might also be worth scheduling regular check-ins to provide feedback to those teams to keep things running smoothly and ensure everyone’s on the same page.

Am I aware of changes happening in the business?

Business conditions don’t stay the same, so neither should your forecast. Is your company launching new products, expanding into new markets, or undergoing major changes? All of these factors can have a big impact on cash flow, and your forecast needs to reflect that. Staying in the loop on key business developments will help you adjust your forecast as needed and keep it as accurate as possible.

By keeping an ear to the ground on what’s happening in the company, you’ll be better equipped to anticipate cash needs and provide more meaningful insights to leadership.

Could your cash be used more efficiently?

One of the key roles of a treasurer is making sure the company’s cash is being used efficiently. Could excess cash be put toward paying down debt, reducing interest expenses, or funding new investments? Or do you need to hold onto more cash to cover short-term obligations?

A well-structured cash flow forecast can help you answer these questions, ensuring you’re making the most of the company’s financial resources and supporting strategic decisions around capital allocation.

How much time are we spending on the forecast—and is it worth it?

Let’s face it: cash forecasting can be time-consuming. But is the time your team is putting into it paying off? Are you getting the insights you need, or is the process bogged down by manual data entry and time-consuming tasks?

If your team is spending more time building the forecast than analysing it, it may be time to consider tools that automate the process. Automation can not only save you time but also improve accuracy, allowing your team to focus on strategic decision-making rather than data collection.

Can I rely on this forecast to make informed decisions?

Once your forecast is complete, the big question is: can you rely on it? Is it accurate enough to inform key decisions like capital investments, liquidity planning, or risk management? Confidence in your forecast is essential—especially when presenting it to senior leadership or the board.

Regularly comparing forecasted cash flows to actual results can help you identify any discrepancies and improve future forecasts. Variance analysis helps ensure that your forecast is not only accurate but also actionable.

Am I taking the time to review and learn from past forecasts?

Finally, it’s important to make time for reflection. Building this into your monthly cycle after each forecast period, review the results and identify what worked well and what didn’t. Were there any recurring errors? Did external factors cause unexpected variances?

Forecasting is an iterative process, and there’s always room for improvement. The key is to continuously fine-tune your strategy based on what you learn along the way.

Wrap Up

Asking the right questions is the foundation of an accurate and actionable cash flow forecast. By focusing on data quality, collaboration, and constant refinement, treasurers can improve forecast accuracy and provide real value to the business. Whether it’s securing liquidity, optimising cash usage, or supporting long-term planning, an effective forecast gives you the insights you need to make informed decisions.

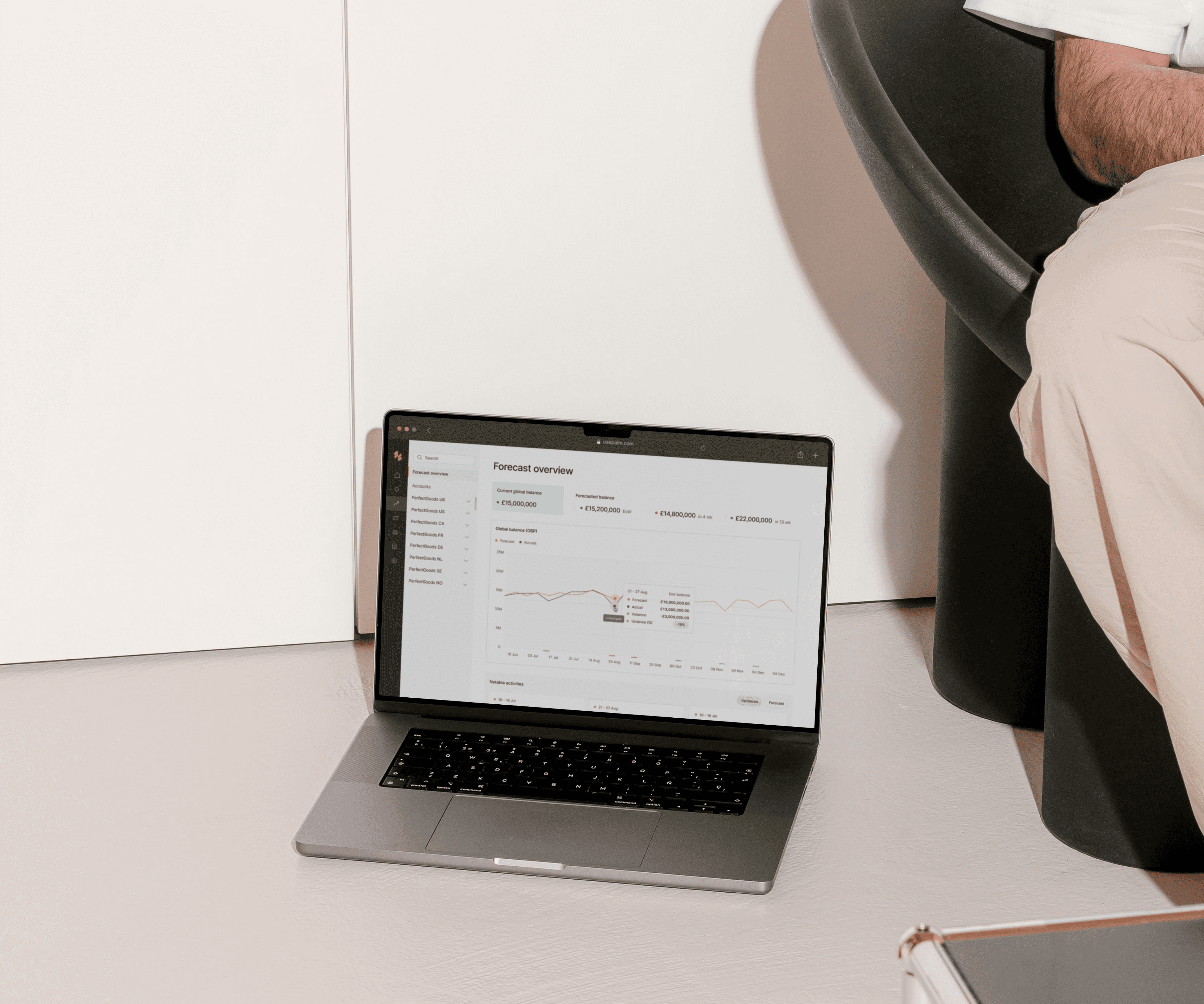

At Palm, we’re here to help you streamline the process. Our Treasury Management Software simplifies forecasting and provides the tools you need to make smarter decisions, faster. Learn more about how Palm can transform your treasury operations at usepalm.com.