A cash flow forecast without variance analysis is like an employee operating without any feedback. Their opportunity to learn, grow, improve and iterate is forgone and they are blind to how well they are performing.

Despite this, many treasurers choose not to expend their scarce resources running a regular and comprehensive variance analysis. Is it because they struggle to step off the metaphorical treadmill, which involves constantly updating and managing the cash forecast, without leaving time to look back over past performance? Or is it simply, that they don't have the insight into the variances, and the visibility to be able to understand and take action to correct differences?

Whatever the reason may be, in this blog post we’ll explore its importance, discuss why businesses often miss out on its benefits, and introduce Palm, a tool that revolutionises variance analysis, giving it life and making daily variance analysis a valuable tool in the treasury toolkit.

What is Variance Analysis?

Variance analysis is a powerful financial analysis tool used to measure the difference between forecasted and actual financial performance. It involves both quantitative and qualitative assessments to provide a comprehensive understanding of financial discrepancies. Quantitative analysis focuses on the numerical differences, while qualitative analysis provides explanations and reasons behind these variances. Calculated as:

For incoming amounts: Actual cash flow - Forecasted cash flow

For outgoing amounts: Forecasted cash flow - Actual cash flow

This ensures the variance is identified correctly as either positive or negative. If the forecasted income is lower than expected, this is a negative variance, whereas if forecasted costs are lower than expected, then this is a positive variance.

By identifying and analysing these differences, we as treasurers can pinpoint areas for improvement, make adjustments, and enhance the effectiveness of the forecast. However, not all variances are created equally. A 100% variance in a small bank account or category may have little impact on the overall forecast, whereas a 5% deviation in the largest bank account could deem the forecast as unreliable. Therefore when doing this process, it is key to focus on correcting the differences that will have the largest impact.

Why is Variance Analysis Important?

The significance of variance analysis cannot be overstated. However, we find larger corporations often overlook variance analysis due to the complexity involved in preparing the forecast and having detailed knowledge of the underlying positions to take corrective action. And in doing so, are missing out on these key benefits:

1. Enhances Financial Accuracy

Regular variance analysis ensures that financial forecasts are accurate and reliable. By comparing actual results with forecasts, businesses can identify deviations and adjust future predictions accordingly. This leads to more precise budgeting and financial planning.

2. Identifies Changes in the Business

As much as treasurers try to stay in the loop, there can be situations when the treasurer is unaware of a significant change which impacts the cash forecast and until variance analysis is conducted, they do not understand the impact. A timely variance analysis can bridge these gaps and improve overall efficiency.

3. Facilitates Strategic Decision-Making

Variance analysis provides valuable insights that inform strategic decision-making. Understanding the reasons behind financial variances can prevent such instances from occurring again in the future.

Introducing Palm: Revolutionising Variance Analysis

Palm has dedicated much time and energy to creating a variance analysis tool, designed to cut through the noise and direct your attention to areas where you can add the most value.

Streamlined Focus

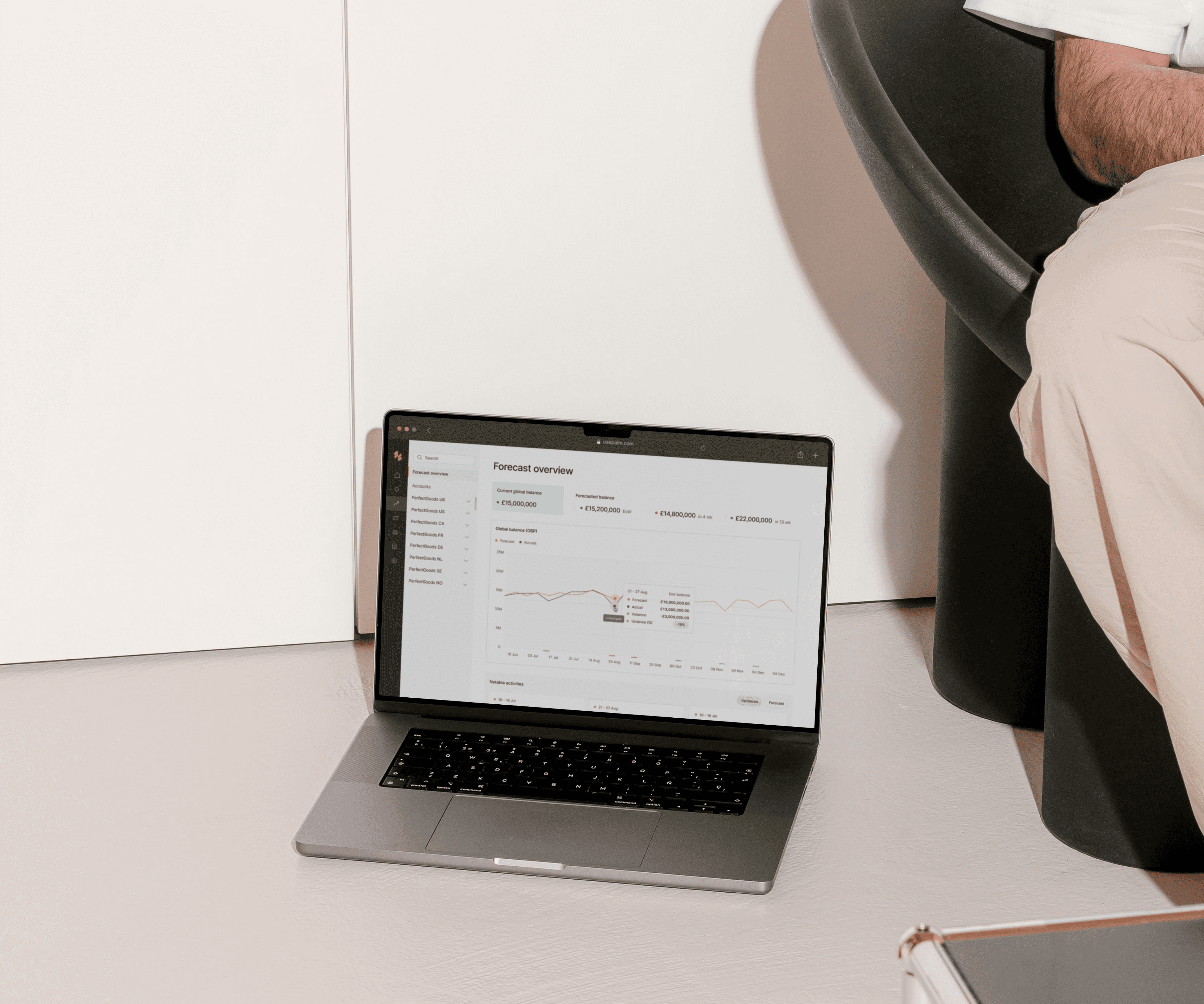

When using Palm each day and working with your cash management and positioning, your attention will be directed to the Notable Activities section of the cash flow dashboard. This is where Palm highlights Palm highlights the variances you need to investigate. This targeted approach allows for quick identification and resolution of financial discrepancies.

Easy Investigations

Investigating variances has never been easier. With Palm, you can drill down from the cash flow into individual transactions and corresponding bank statements. This seamless integration simplifies the investigation process, enabling you to quickly identify the root cause of variances and take corrective action.

Continuous Improvement

Palm's learning capabilities ensure continuous improvement of your forecasts. By feeding back insights from variance analysis into the predictive models, Palm helps train these models to become more accurate over time. This means you can transfer your knowledge and expertise into Palm, allowing it to benefit your team and future members too.

Real-Time Variance Analysis for Proactive Decisions

One of the key advantages of Palm is its ability to integrate variance analysis into the daily operations of the treasury team. Instead of being a retrospective process, variance analysis becomes an ongoing activity, providing real-time insights that drive proactive decision-making.

Staying Ahead of Issues

With real-time variance analysis, you can identify and address issues as they arise, rather than waiting until the end of the month. This proactive approach ensures that potential problems are resolved quickly, minimising their impact on the business.

Improving Forecast Accuracy

By continuously iterating and updating forecasts based on real-time variance analysis, Palm helps improve the accuracy of your financial predictions. This leads to more reliable forecasting and financial planning, enhancing overall financial performance.

Empowering Your Team

Palm's intuitive interface and advanced features empower your team to take ownership of variance analysis. By making this critical process more accessible and manageable, Palm helps your team become more efficient and effective in their roles.

The Palm Advantage

Variance analysis is one of the many tools available in Palm that differentiates the system from incumbent providers. A platform designed by treasurers for treasurers, it is a joy to use, and can add value from day 1. Here are some of the key benefits of using Palm in your treasury:

Advanced Predictive Models

Palm's predictive models, generate a cash flow forecast using your data, which continuously improves over time learning your business and your business insights. As you investigate and correct your variances, we replicate these changes in the future, if you want us to.

User-Friendly Interface

Palm's user-friendly interface makes variance analysis accessible to everyone, regardless of their technical expertise. With intuitive navigation and clear visualisations, Palm simplifies the process of analysing financial variances and finding resolutions at speed.

Seamless Integration

Palm seamlessly integrates with your bank platforms, and your TMS ensuring variances are measured against up-to-date actuals. This integration eliminates the need for manual data entry and reduces the risk of errors, making variance analysis more efficient and effective.

Don't miss out on the benefits of effective variance analysis. Explore the power of Palm and see the impact it can have on your treasury operations. Book a demo with our team today and discover how Palm can transform your approach to variance analysis and cash flow forecast.