Cash forecasting often takes centre stage in board meetings, strategic business discussions, and auditor reports. Having a reliable cash flow forecast model can steer the course of a business. Conversely, a neglected model can sit in a folder, unused, leaving CFOs and treasurers feeling blind and unable to make key strategic decisions.

Whether you opt for a decentralised model that collects inputs from subsidiaries or have the treasury team forecast for the entire business, the level of human intervention is key in determining the efficiency and accuracy of your forecasts. This blog explores common pitfalls in cash forecasting and offers solutions to enhance your forecasting accuracy with Palm’s predicative modelling capabilities and AI toolbox.

Over-reliance on External Inputs

Many companies depend heavily on inputs from subsidiaries or other entities. Unfortunately, contributors often lack consistency, motivation, or the capacity to prepare accurate forecasts, making this a considerable challenge. When various subsidiaries apply different forecasting methods, it leads to inconsistency. This inconsistency can distort the overall cash flow picture, making it hard to trust the forecast.

Contributors may not fully understand the importance of their input or may not have the time to dedicate to accurate forecasting. This lack of engagement can result in half-hearted efforts that compromise the quality of the data.

Without proper training, employees might not be equipped to provide reliable forecasts. This knowledge gap can lead to errors that cumulatively affect the entire cash flow model.

The Challenge of Combining Data

Combining data from various sources can be a painful and time-consuming process. Even with standardised formats, variations in how regions classify entries and inconsistencies month-on-month can occur.

Time-consuming Data Combination

Merging data from different sources requires significant time and effort. This process can delay the finalisation of forecasts, making them less useful for timely decision-making.

Variations in Data Entry

Despite using standardised formats, regions may still classify entries differently. These variations can create discrepancies that need to be reconciled, adding another layer of complexity.

Inconsistencies Over Time

Month-on-month inconsistencies can arise due to changes in classification or data entry mistakes. These inconsistencies can make it difficult to compare forecasts over time, reducing their reliability.

The Difficulty of Assessing Submissions for Errors

Assessing submissions for erroneous figures can be challenging without in-depth local knowledge. This difficulty can lead to overlooked errors that compromise the entire forecast. However, even small errors can snowball, without providing quality feedback to those preparing the entries.

Currency Challenges in Forecasting

Currency challenges often arise when forecasts are prepared in local currencies. While this approach provides detailed insights, converting these forecasts into the reporting currency can be complex.

Converting local currency forecasts into the reporting currency can be challenging. Using spot rates or budget rates can distort the numbers. If using a hedge rate or a forward rate, this could increase the accuracy of the long-term forecast specifically.

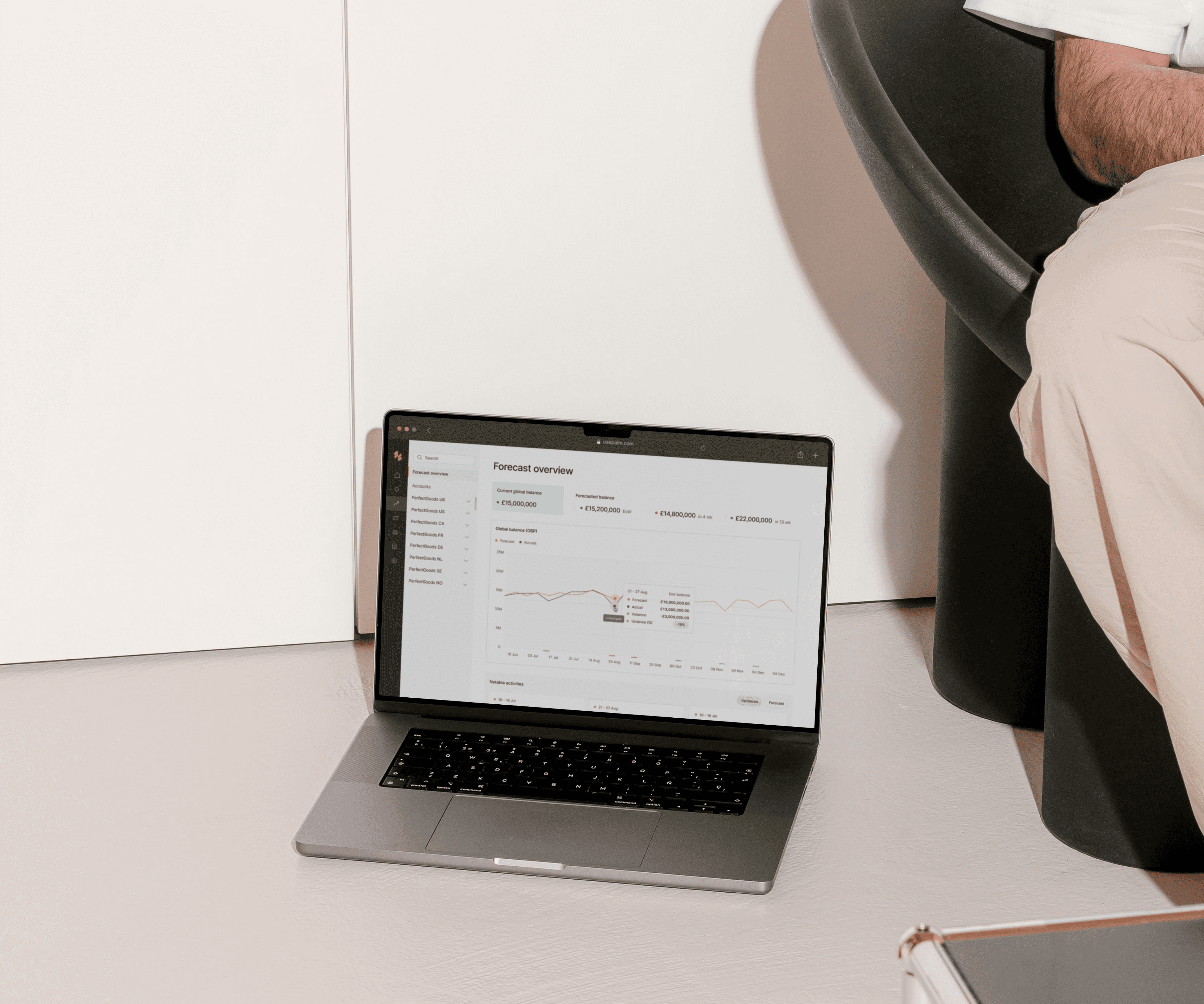

Enhancing Cash Forecasting with Palm

Palm provides a solution that addresses these common pitfalls. By consuming and analysing historical data, Palm's AI and predictive models can generate a reliable cash flow forecast you can start using in days.

Automated Data Collection

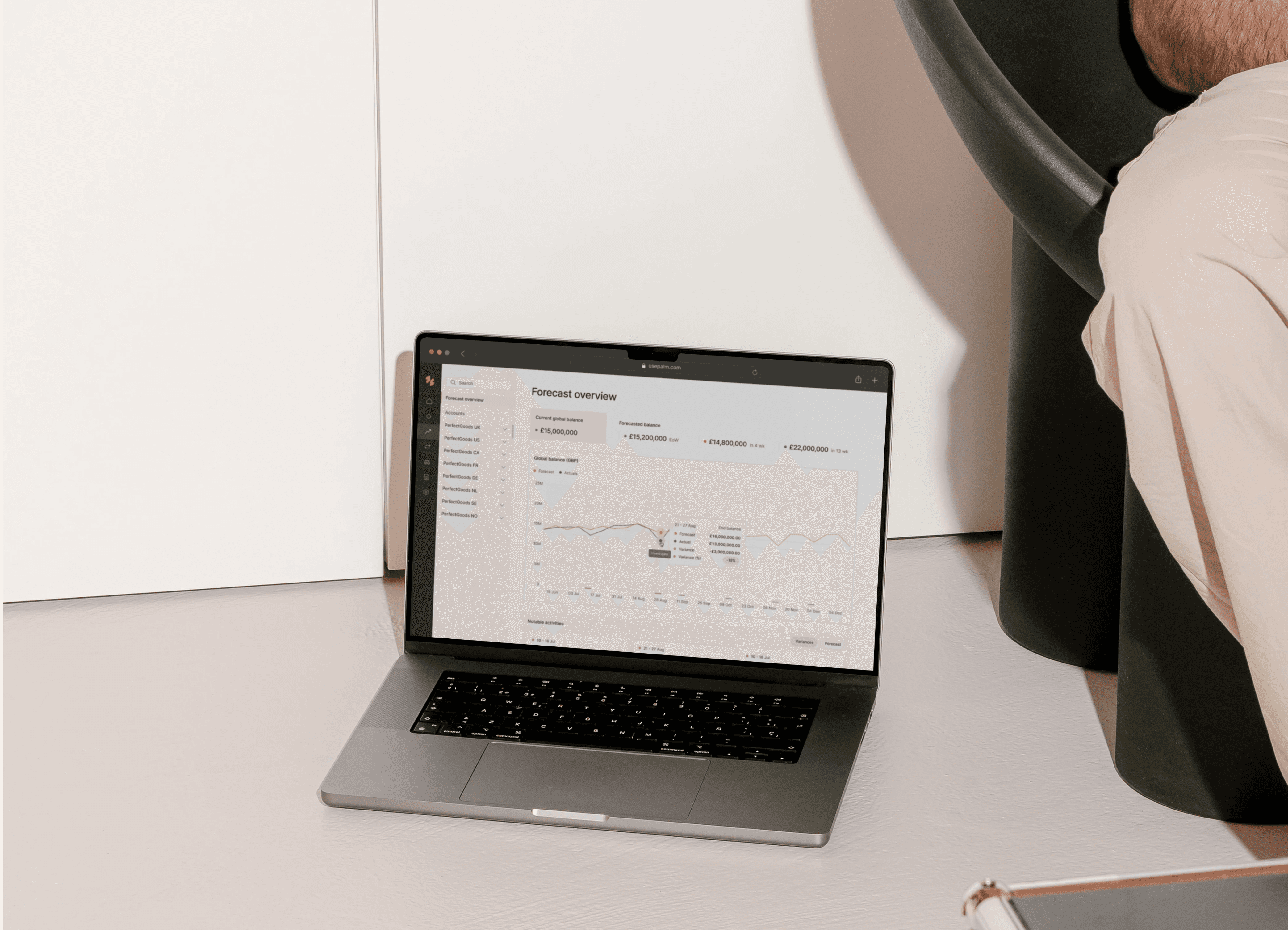

Palm automates data collection from your bank statements, and TMS via API connectivity, reducing the time and effort required for manual data collection. This automation ensures that your forecasts are based on the most up-to-date information. Then, utilising AI and predictive to identify patterns and trends that are not obvious to the human brain. This gives you confidence in your forecast and numbers, by verifying your assumptions and seeing them brought to life through the cash forecast. In Palm forecasts refresh daily with all the latest information available, ensuring that your numbers remain current and reliable.

Adding Human Insights to AI Models

While Palm's AI models provide a solid foundation, your insight and knowledge give Palm valuable information to help refine the forecasts in the future. Palm employs machine learning technology to take your understanding, apply it to the forecast and enhance accuracy over time based on the adjustments you make. As you feed more data into the model, it learns about your business, this continuous learning, makes Palm's models more accurate the more of your gut instinct you share in the platform.

Reducing Time Spent Updating the Forecasting

Palm reduces the time spent creating, collecting, and consolidating forecasts. This reduction allows you to focus on important tasks like variance analysis.

Focus on Variance Analysis

Palm's variance analysis feature highlights notable areas, helping you focus on differences where you can have the largest impact on forecast accuracy. This focus ensures that you are making the most of your efforts. By completing regular variance reviews, you can continuously improve your forecasts and iron out those deviations.

Improving Cash Management for Treasurers

Having a cash forecast you can rely upon allows treasurers to run tighter cash management programmes and optimise interest income or reduce debt drawings to ensure that you can make the most of your available cash. Reduce buffers held in bank accounts, and use that idle cash to generate positive cash flow into the business.

Taking the Next Step with Palm

If you're interested in learning more about Palm, book a demo with the team today and see how the model works using your data. This opportunity allows you to experience the benefits of Palm firsthand and understand how it can transform your cash forecasting process.