Unleashing the Power of Data in Treasury Management

The skills required to be successful in treasury are changing, and more and more treasurers seek to hire candidates who are proficient in data management. As data becomes a critical asset of all businesses, this too is reshaping how treasurers and CFOs design their functions. This blog will explore how data-driven treasuries are not just a trend, but the future of corporate finance. We'll discuss the evolving role of key financial players, and offer practical insights to help your treasury stay ahead of the curve.

The Rising Importance of Data in Treasury Management

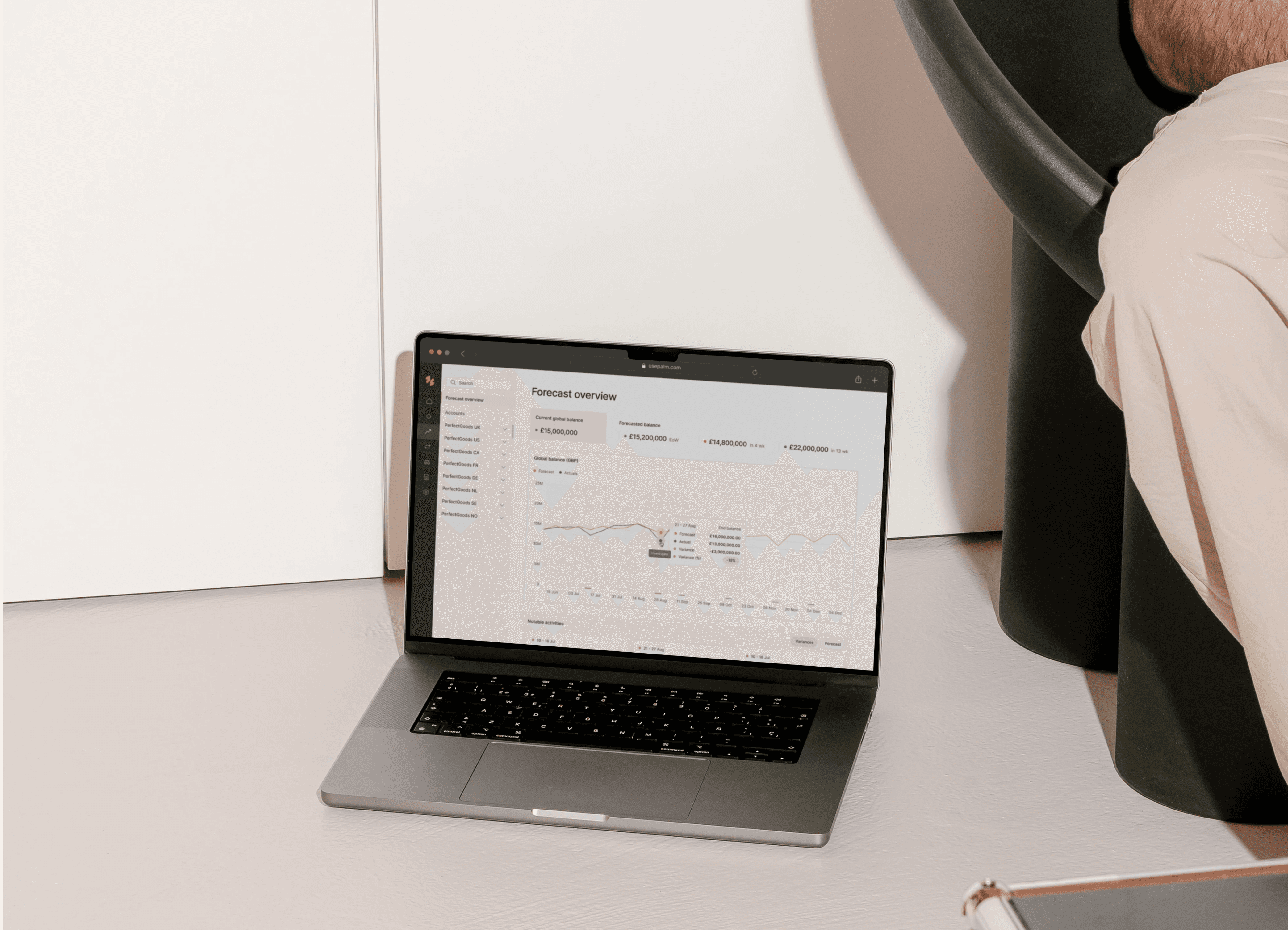

Data is often referred to as the new oil—a resource that fuels decision-making and strategy in modern businesses. In treasury management, data's role is no less significant. It enables treasurers to gain insights into cash flow, liquidity, and risk management. In an era where precision and speed are crucial, treasurers need access to accurate and timely data to make informed decisions. This reliance on data not only improves operational efficiency but also enhances strategic planning. Gone are the days when cash flow forecasts were collected in spreadsheets. Now, Treasurers are utilising data and statistical models in Palm to develop their cash forecasting solutions.

The traditional treasury functions focused on only a few core tasks such as cash management and financial risk management are rare. Today treasurers are expected to do much more. They need to anticipate cash shortfalls, optimise working capital, and ensure compliance with evolving regulations. Data provides the necessary insights to meet these demands effectively. By harnessing the power of data, treasurers can create predictive models that forecast future trends and prepare for uncertainties.

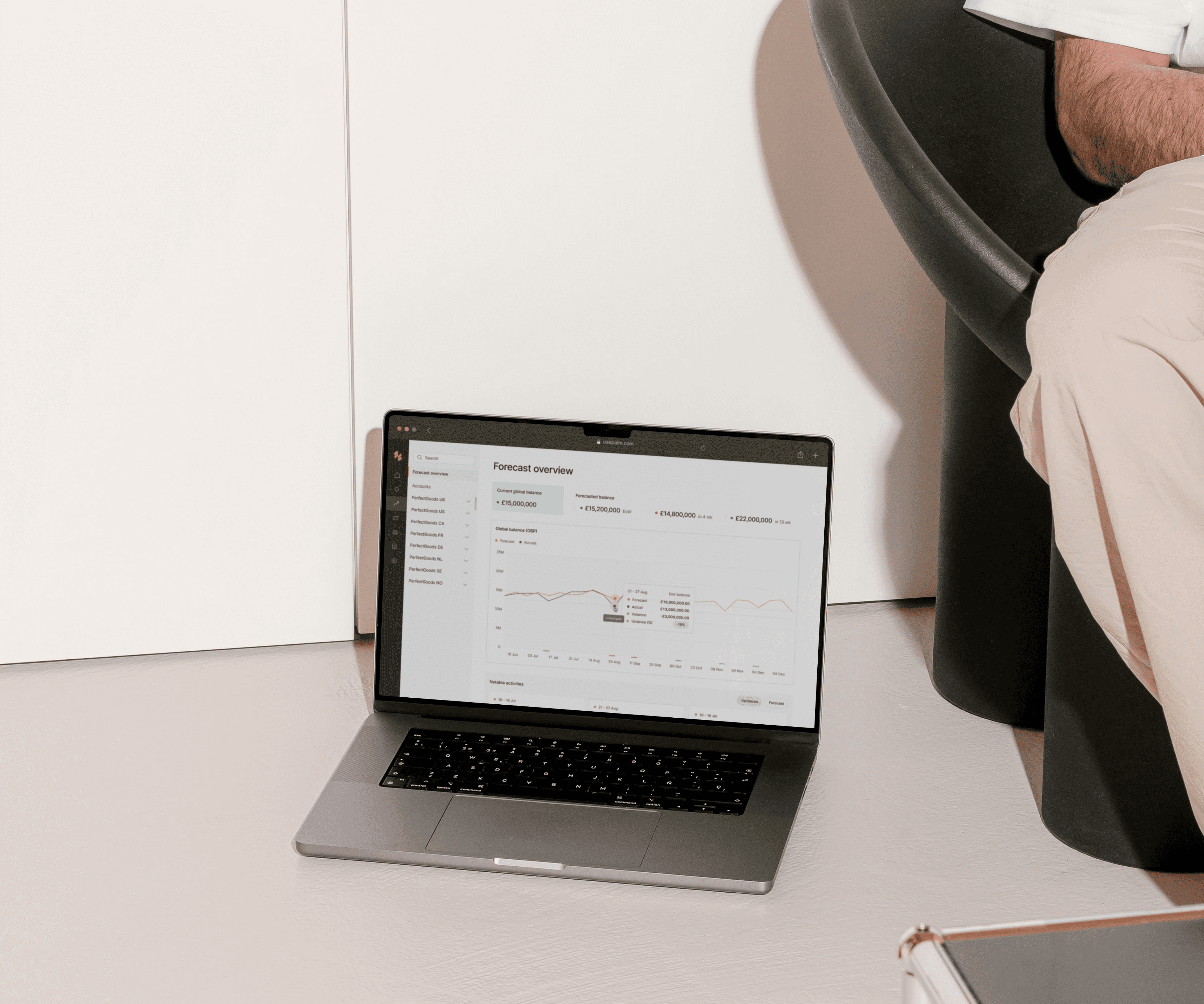

The integration of data into treasury management processes allows for real-time monitoring and analysis. Palm uses API technology to connect to your banks, ERP and TMS so all data is centralised in one place. Allowing your treasury to become proactive rather than reactive.

The Evolving Role of Treasurers and CFOs with Data

As the landscape of corporate finance evolves, so too does the role of treasurers and CFOs. These key players are increasingly becoming strategic partners within their organisations, using data to drive critical business decisions. The days when financial leaders only focused on balance sheets and income statements are long gone. Today, they are expected to be data-savvy leaders who understand the broader economic context and its impact on their organisations.

Treasurers and CFOs are using Palm to leverage data to break down silos across departments, fostering a more collaborative environment. By sharing insights from treasury data, they can provide valuable input into sales forecasts, marketing budgets, and operational plans. This holistic approach ensures alignment between financial goals and overall business objectives.

Data-driven decision-making empowers treasurers to optimise their organisations' capital structures. They can assess various funding sources, analyse interest rate trends, and evaluate currency risks to make informed choices. By incorporating data analytics into capital allocation decisions, treasurers can enhance returns on investments and reduce borrowing costs. This strategic use of data ultimately strengthens the organisation's financial position.

AI and Data Management

Palm utilises artificial intelligence (AI) and machine learning algorithms to offer powerful tools for data analysis. By analysing historical data and identifying patterns, AI can generate accurate forecasts and identify emerging trends unknown to a human brain. This capability empowers treasurers to make data-driven decisions with the support of emerging technology. Furthermore, AI-driven automation streamlines repetitive tasks, freeing up valuable time for treasury teams to focus on strategic initiatives.

Practical Tips for Implementing a Data-driven Strategy

Implementing a data-driven strategy in treasury management requires careful planning and execution. Here are some practical tips to help your organisation get started:

Define Clear Objectives: Begin by identifying the key objectives you want to achieve with data-driven treasury management. Whether it's optimising cash flow, improving risk management, or enhancing decision-making, having clear goals will guide your strategy.

Invest in the Right Technology: Evaluate different technology solutions available in the market and choose those that align with your organisation's needs. Look for platforms like Palm's that offer robust data analytics capabilities, integration with existing systems, and scalability for future growth.

Build a Data-driven Culture: Foster a culture of data-driven decision-making within your organisation. Encourage collaboration between departments and provide training programs to enhance data literacy among employees. By empowering your team with the skills to analyse and interpret data, you can unlock its full potential.

Data-driven Treasuries are the Future

Data-driven treasuries represent the future of corporate finance. Treasurers and CFOs who embrace this paradigm shift will gain a competitive edge, positioning their organisations for success in an increasingly complex business environment. By leveraging data, these financial leaders can optimise operations, improve risk management, and drive strategic decision-making.

Remember, data is not just a tool—it's a strategic asset that holds the key to accurate cash forecasts, better cash positioning, better decision making and ultimately business success.