Share content

In today's fast-paced financial environment, treasurers at large global corporations face a relentless challenge: making sense of vast amounts of data to make informed decisions. But one of the most persistent frustrations is the ineffectiveness of enterprise reporting tools. Despite significant investments in Business Intelligence (BI) platforms, reporting remains an obstacle rather than an enabler for many organizations.

Treasurers typically have three main options for reporting:

BI Tools

Offer powerful analytics and customization.

Require significant integration work, maintenance, and training.

Reporting Suite in TMS or ERP

Streamlined and built specifically for treasury functions.

Can be rigid with less flexibility for custom reporting.

Raw Data into Excel

Provides full flexibility to build custom reports and models.

Time-consuming and prone to errors, especially with large datasets.

Why Are Existing Systems Hard to Use?

Inability to Mix and Match Data Sources

One of the most critical limitations in many reporting systems is their inability to seamlessly combine data from different sources. This can be data that comes from multiple platforms—ERP systems, banking partners, cash management systems, and more. But more often than not systems already struggle to combine balances and cashflows in a single report. Without flexibility in how data sources are connected, getting a comprehensive view of an organization’s cash flow or financial health becomes a daunting task.

Challenges in Defining Metrics Correctly

Financial reporting depends heavily on getting the definitions of metrics right. Key metrics like Free Cash Flow (FCF) or variance metrics can vary across different departments or regions, leading to inconsistencies. A free cash flow metric might include certain liabilities in one report but exclude them in another. The lack of standardization or customizable definitions in most enterprise tools results in reports that can be misaligned or, worse, misleading.

Compiling Individual Views Into a Coherent Report

It's not enough to analyze individual data sets. Treasurers need a consolidated report that tells the full story. Existing systems often fall short because they don’t allow for the seamless integration of multiple views. As a result, the process of compiling a single, coherent report is manual, time-consuming, and prone to errors. Treasurers end up spending more time preparing reports than actually analyzing the data within them.

What Makes a Good Embedded Analytics Tool?

A robust reporting solution is not just about processing data; it’s about making data actionable and intuitive. A good reporting tool should include the following key components:

Data Sources

The ability to connect and combine multiple data sources easily, enabling treasurers to pull in data from ERPs, banks, and other relevant systems without requiring weeks of engineering work.

Charts

Visual representation of data through charts is essential for quick analysis. A well-designed tool provides treasurers with a range of chart options—bar graphs, line charts, and more—to visualize trends, variances, and anomalies instantly.

Filters

Sophisticated filters allow users to drill down into the data. Whether it's by region, department, or time period, having customizable filters makes it easy to isolate specific data sets for deeper analysis.

Slices

An effective analytics tool must allow users to “slice” data in multiple ways. For example, slicing cash flow data by region or currency can reveal hidden insights that are not immediately apparent in aggregated figures.

Comparisons

Treasurers often need to compare current performance against historical data or forecasted trends. A good reporting tool provides easy-to-use comparison features, enabling quick variance analyses between periods or different financial scenarios.

Report Builder

To effectively tell a story, the above elements need to be combined into a comprehensive report that lets users combine the different elements on a canvas - and subsequently add commentary.

Why BI Tools Are Sometimes Prohibitive

While BI tools are designed to solve these issues, they often introduce their own set of challenges. Here’s why many enterprises find them prohibitive:

+ Heavy Integration Work

The time and resources required to integrate a BI tool into an enterprise system can be significant. From connecting various data sources to customizing reports, the setup phase alone can take months, leaving treasurers waiting for a solution that still doesn’t address their immediate reporting needs.

+ High Engineering Costs

Once a BI tool is in place, the costs don’t stop at integration. Ongoing maintenance, custom report building, and troubleshooting all require significant engineering support. Many companies find themselves dependent on technical teams to make even minor adjustments, adding to the overall expense.

+ Extensive Training Required

BI tools can be complex. The advanced functionalities that make these tools powerful often come with a steep learning curve. For treasurers who are focused on making quick decisions, the time spent on training and navigating these systems can outweigh the benefits. What should be a tool for enabling decision-making becomes another barrier.

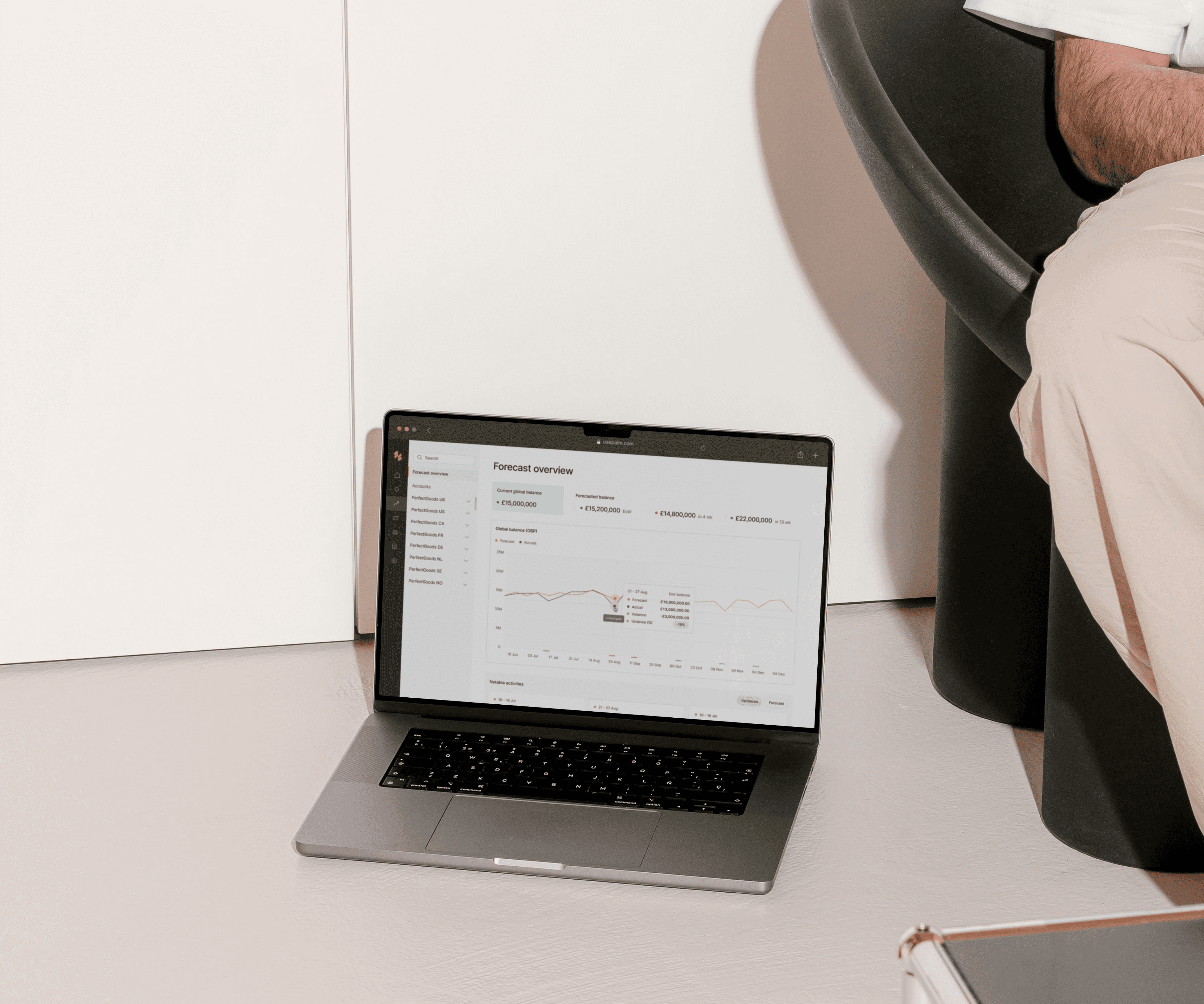

Reporting is NOT Magic – Solutions Exist

Reporting shouldn’t be a mystical or overwhelming task. Solutions exist that simplify the process without requiring months of engineering work or extensive training. At Palm, we’ve designed a Treasury Management Software that prioritizes intuitive, embedded analytics. With our platform, treasurers can quickly connect their data sources, customize their metrics, and generate coherent, insightful reports with minimal effort. For any deep custom analysis, we offer download & email options.